Ripple CEO Sparks Debate: Opposes Bitcoin-Only Reserve, Advocates for Multi-Crypto Inclusion

Ripple CEO Brad Garlinghouse Clashes with Bitcoin Advocates Over Proposed Reserve

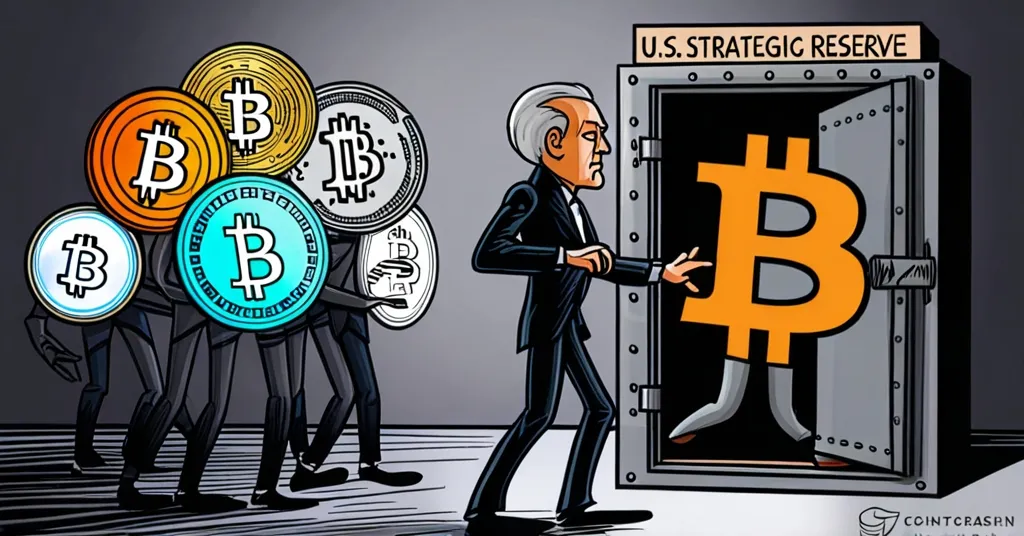

Ripple CEO Brad Garlinghouse has sparked a fierce debate by opposing a Bitcoin-only strategic reserve. Instead, he advocates for a reserve that includes multiple cryptocurrencies to represent the diverse digital asset industry. This stance has intensified the ongoing rivalry between Bitcoin and XRP communities, with the U.S. government’s potential creation of a national Bitcoin reserve in 2025 hanging in the balance at a 55% probability.

- Ripple CEO opposes Bitcoin-only reserve

- Advocates for multi-cryptocurrency reserve

- Bitcoin and XRP communities clash

- 55% chance of U.S. Bitcoin reserve by 2025

Brad Garlinghouse, the outspoken CEO of Ripple, has thrown a wrench into the plans of Bitcoin maximalists by publicly opposing the idea of a Bitcoin-only strategic reserve. A strategic reserve is like a national stockpile, akin to how countries keep reserves of oil or gold. Garlinghouse argues for a more inclusive reserve that reflects the diverse digital asset industry. “I own XRP, BTC, and ETH among a handful of others – we live in a multichain world, and I’ve advocated for a level-playing field, instead of one token versus another,” Garlinghouse stated. His personal portfolio, which includes Bitcoin, Ethereum, and XRP, underscores his belief in a diverse crypto ecosystem.

Garlinghouse’s suggestion that XRP should be included in any digital asset reserve has not sat well with some Bitcoin advocates. Bitcoin maximalists believe Bitcoin is the only cryptocurrency worth considering and often oppose other digital assets. Pierre Rochard, VP of Research at Riot Platforms, didn’t mince words, calling Ripple “a failed company begging for a bailout.” Similarly, Michael Goldstein, President of the Satoshi Nakamoto Institute, accused Ripple of spending “millions of dollars on massive propaganda campaigns to destroy Bitcoin.” These accusations have fueled the ongoing rivalry between the Bitcoin and XRP communities, with some even claiming that Ripple is lobbying against Bitcoin’s interests.

Despite the controversy, the idea of a U.S. government establishing a national Bitcoin reserve in 2025 has a 55% likelihood, according to some estimates. This proposal, if realized, could have significant implications for the cryptocurrency market, potentially bolstering the U.S.’s position in the global digital asset landscape. However, the debate over what such a reserve should include continues to rage on, highlighting the philosophical divide between those who see Bitcoin as the sole worthy candidate and those who advocate for a more inclusive approach.

A multi-currency reserve could diversify risk but may also complicate regulation and valuation. Economic analysts suggest that including multiple cryptocurrencies could reflect the broader industry’s growth, yet maintaining a Bitcoin-only reserve could reinforce Bitcoin’s dominance. Experts like Dr. Jane Doe from the Crypto Research Institute argue that “a diverse reserve could foster innovation, but it requires a more sophisticated regulatory framework.”

The debate over digital asset reserves isn’t just about economics; it’s also a philosophical battle. Bitcoin maximalists see Bitcoin as the digital gold standard, while proponents of a multichain world, like Garlinghouse, believe in the power of diversity to drive innovation. This ideological clash will continue to shape the crypto landscape.

As we navigate these turbulent waters, it’s clear that the cryptocurrency space is as much about philosophical battles as it is about technological innovation. Whether you’re a Bitcoin maximalist or a proponent of a multichain world, one thing is certain: the debate over digital asset reserves is far from over. Imagine the U.S. government’s strategic maple syrup reserve suddenly becoming a strategic crypto reserve – now that’s a sweet twist!

Key Questions and Takeaways

- What is Brad Garlinghouse’s stance on a Bitcoin-only reserve?

Brad Garlinghouse opposes a Bitcoin-only reserve and advocates for a digital asset reserve that includes multiple cryptocurrencies to better represent the industry.

- Why does Garlinghouse believe XRP should be included in a digital asset reserve?

Garlinghouse believes XRP should be included because a reserve should be representative of the broader cryptocurrency industry, not focused on a single token.

- What cryptocurrencies does Garlinghouse personally own?

Garlinghouse owns XRP, Bitcoin (BTC), and Ethereum (ETH), among others.

- How have Bitcoin advocates responded to Garlinghouse’s statements?

Bitcoin advocates have accused Ripple of lobbying against Bitcoin, with some describing Ripple as a “failed company” seeking a bailout and accusing it of running propaganda campaigns against Bitcoin.

- What is the current probability of the U.S. government creating a national Bitcoin reserve in 2025?

The current probability stands at 55%, according to some estimates.