Ripple’s RLUSD Stablecoin Hits $120M Milestone, Expands on Ethereum and XRP

Ripple’s RLUSD Stablecoin Surpasses $120 Million in Total Supply

Ripple’s RLUSD stablecoin has hit a major milestone, surpassing a total supply of $120 million. This marks a significant achievement for the stablecoin, highlighting its growth and acceptance within the cryptocurrency market.

- RLUSD total supply exceeds $120 million

- Stablecoin gains traction on XRP Ledger and Ethereum

- Listed on major platforms like Bitstamp, Revolut, and Zero Hash

Since its launch, RLUSD has quickly gained ground, reaching the $100 million mark in January. On February 10, Ripple created an additional 1.05 million RLUSD tokens, further boosting its supply. Initially, the stablecoin’s growth was concentrated on the Ethereum blockchain, but it has since expanded to the XRP Ledger. For those new to the scene, Ethereum and XRP Ledger are blockchain platforms where cryptocurrency transactions take place. However, the majority of RLUSD’s circulating supply still resides on Ethereum.

Charles Hoskinson, the founder of Cardano, has expressed interest in integrating RLUSD into his blockchain ecosystem. This move could potentially enhance RLUSD’s utility and attract more liquidity to Cardano, highlighting the growing trend of interoperability among blockchain platforms. Cardano, for the uninitiated, is another blockchain platform that aims to provide a more secure and scalable infrastructure for smart contracts. Charles Hoskinson’s interest in RLUSD could be a game-changer.

RLUSD’s journey to this point was paved with regulatory approval from the New York Department of Financial Services (NYDFS), a critical factor for mainstream adoption and trust in stablecoins. A stablecoin, by the way, is a type of cryptocurrency designed to maintain a stable value, often pegged to a fiat currency like the US dollar. The stablecoin has also been listed on major trading platforms such as Bitstamp, Revolut, and Zero Hash, indicating increasing acceptance and accessibility.

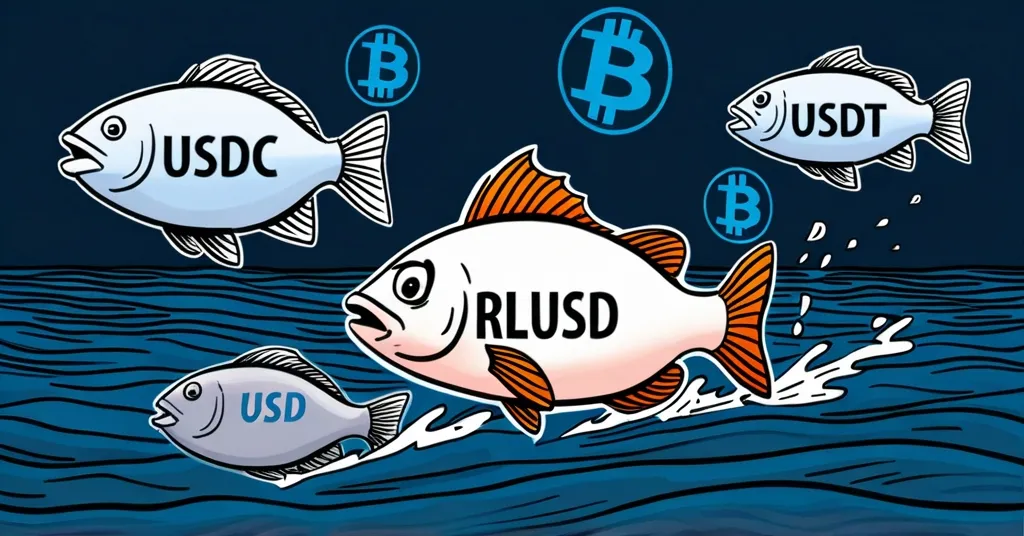

Despite these achievements, RLUSD remains a smaller player compared to market leaders like USDC and USDT, which boast market caps of $56.5 billion and $142 billion, respectively. However, Ripple’s established network, including partnerships with MoneyGram and Santander, provides RLUSD with a solid foundation for further growth. Market cap, for those not in the know, refers to the total market value of a cryptocurrency’s circulating supply. Comparison of RLUSD market cap with USDC and USDT shows the scale of the challenge ahead.

The stablecoin market has grown by 56% this year, driven by institutional adoption and global demand for stable digital assets. RLUSD’s entry into this market is timely, and its backing by U.S. Treasuries adds to its stability and trustworthiness. As the U.S. moves toward clearer regulations for stablecoins, RLUSD’s compliance with NYDFS standards could position it as a bridge between traditional finance and the blockchain future.

Looking ahead, greater support from leading exchanges like Binance and Coinbase, along with integration into Ripple’s payments business, could significantly boost RLUSD’s adoption and market presence. However, RLUSD faces stiff competition from established stablecoins like USDT and USDC, as well as newer entrants like PayPal’s PYUSD. While RLUSD’s regulatory compliance and Ripple’s payment infrastructure offer a competitive edge, the stablecoin’s journey is not without challenges. It must navigate the complexities of a crowded market and continue to build trust and liquidity to challenge the dominance of market leaders.

While the crypto world often gets swept up in the wild west of altcoins and ICOs, RLUSD’s growth showcases the potential of regulated stablecoins to bring some much-needed stability to the space. Yet, as much as we champion the disruptive force of cryptocurrencies, we can’t ignore the fact that RLUSD is still a tiny fish in a big pond, swimming against the currents of giants like USDC and USDT. But hey, in a world where Bitcoin reigns supreme, it’s refreshing to see other players like RLUSD trying to carve out their niche. After all, a rising tide lifts all boats, even if some are just little rubber dinghies. Ripple’s RLUSD reaching this milestone is a testament to the potential of regulated stablecoins.

Key Questions and Takeaways

- What is the current total supply of RLUSD?

The total supply of RLUSD has surpassed $120 million.

- On which blockchains is RLUSD primarily used?

RLUSD is primarily used on the Ethereum blockchain and has started to gain traction on the XRP Ledger.

- Who is working on integrating RLUSD with Cardano?

Charles Hoskinson, the founder of Cardano, is working on integrating RLUSD.

- Which trading platforms have listed RLUSD?

RLUSD has been listed on Bitstamp, Revolut, and Zero Hash.

- How does RLUSD’s market cap compare to that of USDC and USDT?

RLUSD’s total supply of $120 million is significantly lower than USDC’s $56.5 billion and USDT’s $142 billion market caps.

- When was RLUSD launched?

RLUSD was launched last month after obtaining necessary regulatory approval.

- What is the significance of RLUSD reaching $120 million in total supply?

Reaching $120 million in total supply is described as a “huge milestone” for RLUSD, particularly given its status as a highly regulated stablecoin.

In the realm of decentralization and financial freedom, RLUSD’s growth is a promising sign for those of us who believe in the transformative power of blockchain technology. While it may not challenge Bitcoin’s dominance anytime soon, RLUSD’s journey underscores the vibrant diversity of the crypto ecosystem. As we continue to push for effective accelerationism and disrupt the status quo, let’s keep an eye on RLUSD and other innovative projects that could play a role in shaping the future of finance. Discussions about RLUSD’s potential can be found on Reddit and Quora.