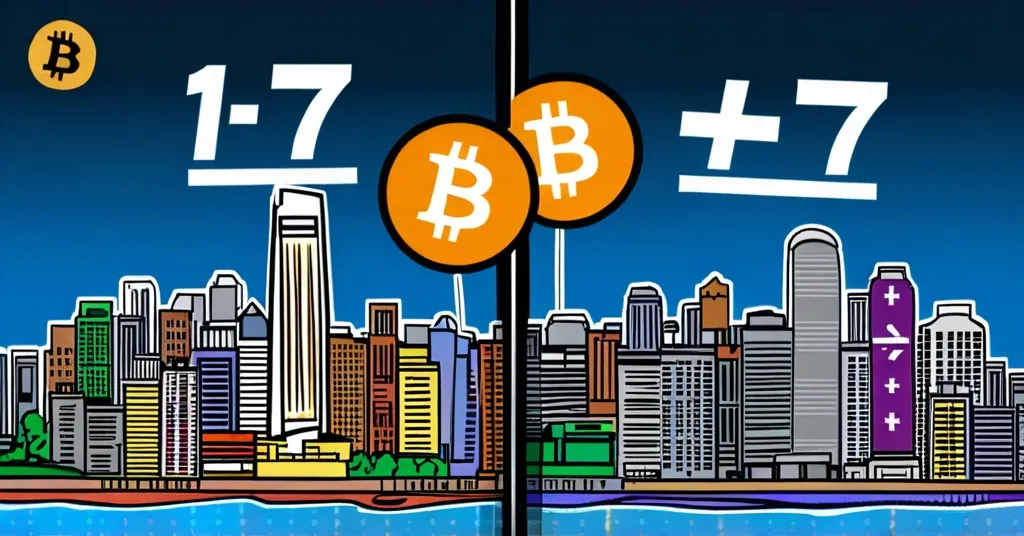

Singapore Overtakes Hong Kong as Top Digital Assets Hub with 13 Crypto Licenses in 2024

Singapore Surpasses Hong Kong as Digital Assets Leader in 2024

In a strategic maneuver that has propelled it past Hong Kong, Singapore has emerged as the leading hub for digital assets by issuing an impressive 13 cryptocurrency licenses in 2024. This significant increase highlights Singapore’s ambition to dominate the global crypto landscape.

- 13 crypto licenses issued in Singapore in 2024

- Major firms like OKX, Upbit, Anchorage, and BitGo licensed

- Hong Kong issues only seven full licenses with seven provisional

- Stricter Hong Kong regulations may be a deterrent

Singapore’s Crypto Licensing Surge

Singapore’s approach centers on a flexible regulatory framework, allowing it to accelerate ahead of Hong Kong, which is encumbered by stringent regulations. Prominent players such as OKX and Upbit, alongside global entities like Anchorage and BitGo, have received licenses in Singapore, showcasing the city-state’s allure for cryptocurrency firms. In stark contrast, Hong Kong, with its prolonged and more restrictive licensing process, has witnessed exchanges like OKX and Bybit withdraw their applications.

Hong Kong’s Regulatory Challenges

Hong Kong’s meticulous focus on customer asset custody and token policies has resulted in a sluggish licensing process. This rigidity is pushing some exchanges to favor Singapore’s more accommodating environment. According to Angela Ang, senior policy adviser at TRM Labs, this regulatory difference has tipped the scales:

“Hong Kong’s rules are stricter in areas like customer asset custody and token policies, which may have tilted the scale toward Singapore.”

As the digital assets space matures, the rivalry between Singapore and Hong Kong emphasizes the necessity for a balanced regulatory approach that promotes innovation while ensuring stability and security. While Singapore’s leniency is alluring, it will need to tread cautiously to avoid compromising compliance standards. Meanwhile, Hong Kong’s focus on high-liquidity cryptocurrencies like Bitcoin and Ethereum demonstrates a cautious yet stable trajectory, potentially sidelining altcoins and innovative startups.

Key Takeaways and Questions

Why is Singapore leading over Hong Kong in the digital assets sector?

Singapore’s lenient regulatory approach and fast-tracked licensing process are key attractions.

Which major firms received crypto licenses in Singapore in 2024?

Major licenses were granted to OKX, Upbit, Anchorage, BitGo, and GSR.

What are Hong Kong’s challenges in attracting crypto businesses?

Stricter regulations on asset custody and token policies pose significant challenges.

How many crypto licenses has Hong Kong issued compared to Singapore?

Hong Kong issued seven full and seven provisional licenses, compared to Singapore’s 13.

As Singapore continues to forge ahead, ensuring it maintains robust security and compliance measures will be critical. For Hong Kong, adapting its regulatory stance to not only secure stability but also invite innovation will be crucial for staying competitive in the digital assets landscape.