Social Media Fuels Crypto Investment: Navigating Hype, Risks, and Trends

Social Media’s Growing Role in Crypto Investment: Navigating the Hype and Risks

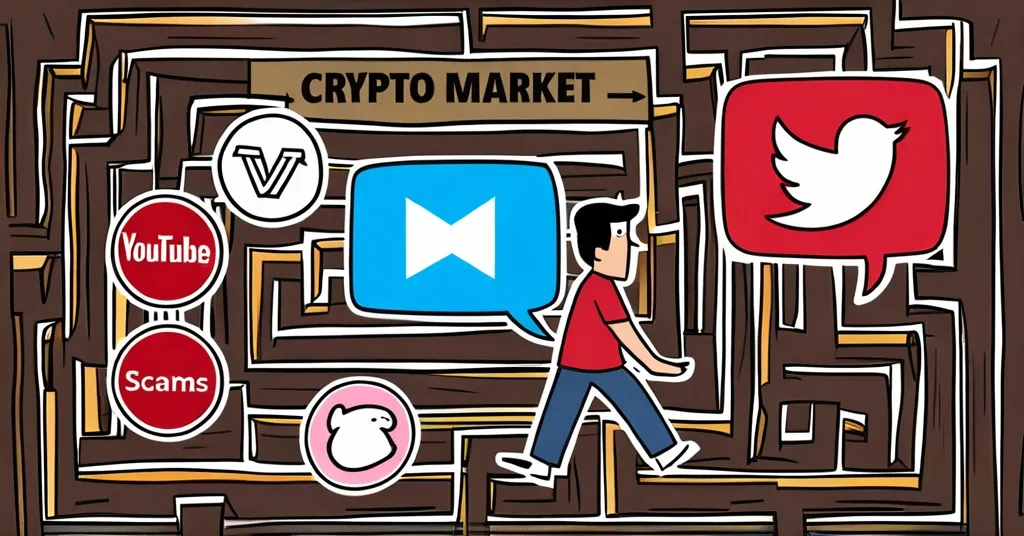

Social media has become a pivotal force in cryptocurrency investment, influencing decisions and driving market trends. A recent study from the University of Georgia underscores the significant role platforms like YouTube, Reddit, Twitter, and Clubhouse play in shaping crypto investment behaviors.

- Social media drives crypto investment.

- Demographics influence investment patterns.

- Risks include misinformation and scams.

- Recommendations focus on literacy and regulation.

The Impact of Social Media on Crypto Investment

Let’s be real, social media isn’t just for cat videos anymore; it’s a powerhouse in the world of cryptocurrency investment. According to the University of Georgia study, about half of social media users have ventured into the crypto market, compared to a mere 10% of non-users. The more platforms you’re on, the more likely you are to invest. YouTube, Reddit, Twitter, and Clubhouse are leading the charge, while Instagram seems less influential in the crypto sphere.

Take Jake, a 25-year-old tech enthusiast. He credits his crypto investments to the buzz he encountered on Reddit and Twitter. “Seeing so many people talk about it made me think, ‘Why not give it a shot?'” Jake’s experience isn’t unique; it’s a testament to the power of social proof, where people are influenced by the actions of others, often leading to investment decisions.

Demographic Trends in Crypto Investment

Who’s diving into the crypto pool? The study reveals that men, younger adults, and those with a higher risk tolerance are more likely to invest. Interestingly, those with higher education levels tend to be less enthusiastic about crypto. Public awareness and investment have surged from 15% in 2018 to 28% by 2021, reflecting a growing interest across demographics.

Generational attitudes towards risk might explain these trends. Millennials and Gen Z, growing up with digital technologies, are more comfortable navigating the volatility of the crypto market. Conversely, those with higher education might be more skeptical, weighing the risks against potential gains. Other studies, like one from the University of Alabama, similarly found that younger investors are more likely to embrace crypto, supporting the Georgia findings.

The Dark Side: Risks of Social Media-Driven Investment

But with great power comes great responsibility—or in this case, great risk. The study warns of the dark side of social media-driven investment: the spread of misinformation, scams, and the dangerous allure of overconfidence, particularly among younger investors. Lu Fan, an Associate Professor at the University of Georgia, cautions:

“When people see friends, family, or celebrities they admire investing in crypto, it creates a sense of social proof that can drive investment decisions.”

And yet, Fan also advises against blindly following the crowd:

“Crypto markets are highly volatile. Investors need to ask, ‘Does this align with my financial goals? Is it the right investment for me?’ rather than simply following trends.”

Consider the infamous Bitconnect scam, which promised high returns but ultimately collapsed, leaving investors in the lurch. Social media played a significant role in spreading the word about Bitconnect, illustrating how quickly misinformation can spread. Younger adults, as Fan points out, are both the majority of social media users and the most active crypto investors, making them particularly vulnerable:

“Younger adults are both the majority of social media users and the most active crypto investors.”

Recommendations for Navigating the Crypto Market

To navigate the volatile crypto market effectively, the study emphasizes the importance of financial and media literacy. Here are key recommendations to consider:

- Improve Financial and Media Literacy: Understanding finance and media is crucial. This helps navigate the unpredictable world of cryptocurrency.

- Develop Regulatory Frameworks: Policymakers should consider these findings when creating regulations to protect investors and foster a healthier crypto ecosystem.

- Promote Critical Thinking: Encourage individuals to critically assess financial content on social platforms before making investment decisions.

Counterpoints and Critical Thinking

While social media can democratize financial knowledge, it also risks creating echo chambers and spreading misinformation. On one hand, platforms can accelerate the adoption of decentralized finance (DeFi) and challenge traditional financial systems, embodying the spirit of effective accelerationism. On the other hand, the echo chambers can lead to groupthink, where investors are swayed by the latest trend without considering the risks.

Moreover, the hype around cryptocurrencies on social media can sometimes overshadow the fundamental values of decentralization and freedom that underpin technologies like Bitcoin. It’s crucial to maintain a balance between embracing the potential of these technologies and being wary of the pitfalls of social media-driven investment.

Bitcoin Maximalism and the Role of Altcoins

Bitcoin maximalists often view social media as a double-edged sword. While it can promote the adoption of Bitcoin, which they see as the true embodiment of decentralized currency, it can also amplify the noise around altcoins. However, altcoins play crucial roles in the broader crypto ecosystem, filling niches that Bitcoin might not serve well.

Social media’s influence on altcoin adoption is undeniable. Platforms like Twitter have been instrumental in the success of projects like Ethereum, which powers smart contracts and decentralized applications. Yet, Bitcoin maximalists caution against the distractions posed by altcoins, urging investors to focus on the long-term potential of Bitcoin.

Key Questions and Takeaways

What role does social media play in cryptocurrency investment?

Social media significantly influences crypto investment, with platforms like YouTube, Reddit, Twitter, and Clubhouse driving engagement and decisions.

How do demographic factors affect crypto investment patterns?

Men, younger adults, and risk-tolerant individuals are more likely to invest, while those with higher education levels are less engaged.

What risks are associated with crypto investment influenced by social media?

Risks include misinformation, scams, and overconfidence, particularly among younger investors. Financial and media literacy is essential to mitigate these risks.

What recommendations are made to address the influence of social media on crypto investment?

Recommendations include improving financial and media literacy, developing regulatory frameworks, and promoting critical thinking about financial content on social platforms.