South Korea’s Crypto Regulation: Navigating Political Turmoil with Cautious Optimism

South Korea’s Crypto Policy: Balancing Hope with Pragmatism Amid Political Chaos

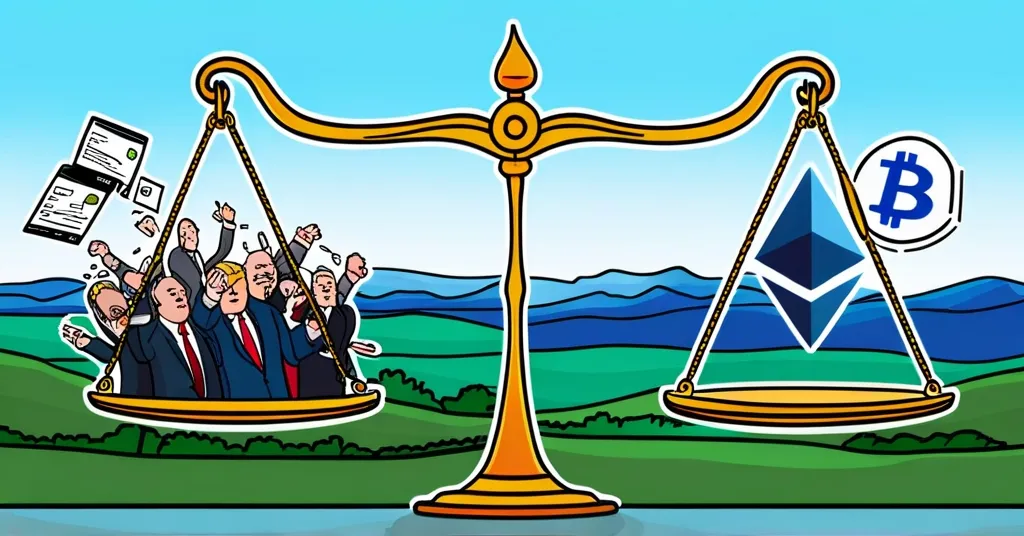

South Korea is grappling with political upheaval following the impeachment of President Yoon Suk-yeol, yet the government maintains a cautiously optimistic stance on cryptocurrencies. Deputy Prime Minister Choi Sang-mok has affirmed that despite the current legislative pause and the deferment of crypto taxes until 2027, the government is committed to formulating a comprehensive regulatory framework. This approach aims to ensure economic stability while addressing the complexities of the crypto sector.

- The South Korean government remains neutral towards cryptocurrencies.

- President Yoon Suk-yeol’s impeachment awaits constitutional court ratification.

- Crypto legislation is paused amid political tension.

- Crypto tax implementation is delayed until 2027.

- The government is focused on establishing robust crypto regulations.

Political Context and Its Impact on Crypto Policies

With President Yoon’s impeachment still pending a ruling from the constitutional court, South Korea finds itself embroiled in political confusion. This situation has caused a legislative standstill, particularly affecting the crypto sector. The People’s Power Party currently leads the government, but faces significant opposition from the Democratic Party, which holds a majority in the National Assembly. This political deadlock complicates the legislative process, including the advancement of crypto regulations.

Despite this, high trading volumes in the South Korean market reveal enduring interest in cryptocurrency. The government’s decision to delay the introduction of crypto taxes until 2027 is not simply a matter of postponement; it reflects a strategic choice to develop a regulatory framework that prioritizes consumer protection and a clear legal classification of digital currencies.

Current Crypto Policy: A Focus on Regulation and Protection

Deputy Prime Minister Choi Sang-mok has emphasized that the government is not opposed to cryptocurrencies. He stated, “The government is not negative on cryptoassets. As regulations and related systems are still in their infancy, we decided to defer the crypto tax launch. We judged that it would be appropriate to monitor the progress of regulations before we introduce taxation.” This stance shows a deliberate, calculated approach to integrating cryptocurrencies into the national economy, balancing innovation with necessary regulatory safeguards.

Global Perspective and Future Implications

Choi’s comments also underscore the relevance of international developments, referencing strategic cryptoasset proposals from US President-elect Donald Trump. “Since the specific details of the strategic cryptoasset proposal from President-elect Trump have not been revealed yet, this is not the time to evaluate it.” This highlights the interconnected nature of global crypto policies and the necessity for adaptive strategies in response to international shifts.

For South Korea, the future of crypto regulation hinges on resolving its current political turmoil. Once stability is achieved, the government plans to renew discussions on creating a regulatory environment that aligns with global standards while fostering local innovation.

Key Considerations for the Crypto Community

- How will South Korea’s political climate affect its long-term crypto policies?

- What are the potential market impacts of delaying crypto taxes until 2027?

- How might international regulatory trends, particularly from significant economies, influence South Korea’s crypto strategy?

South Korea’s approach to cryptocurrency regulation, characterized by an optimistic yet cautious perspective, exemplifies how nations can navigate the complexities of digital asset integration amid political instability. The ongoing groundwork for comprehensive regulation reflects a steadfast commitment to balancing economic stability with innovation.