Latest News and Articles about IRS

Trump Admin Proposes IRS Tax Rules for Foreign Crypto Holdings via CARF

Trump Administration Pushes IRS Tax Framework for Foreign Crypto Holdings The Trump administration is making a bold move that could spell the end of hiding crypto stashes on foreign exchanges to dodge taxes. With a proposal to join the Crypto-Asset Reporting Framework (CARF), the US is inching closer to empowering the Internal Revenue Service (IRS) […]

Read MoreTrish Turner Takes Helm of IRS Crypto Unit Amid Policy Shifts and Turnover

IRS Crypto Unit Appoints Trish Turner Amid Policy Shifts and Leadership Changes The Internal Revenue Service’s crypto unit has undergone a significant leadership transformation with Trish Turner, a seasoned IRS official, taking the helm. This shift follows the exit of Sulolit “Raj” Mukherjee and Seth Wilks, two key figures from the private sector instrumental in […]

Read MoreDan Morehead’s $850M Crypto Tax Probe: Act 60 and IRS Rules Shake Crypto

Dan Morehead Investigated for $850M Crypto Tax Exemptions: Puerto Rico’s Act 60 Under Scrutiny Dan Morehead, the mastermind behind Pantera Capital, finds himself in the crosshairs of the U.S. Senate Finance Committee for leveraging Puerto Rico’s Act 60 to claim tax exemptions on a staggering $850 million in cryptocurrency profits. As new IRS regulations loom, […]

Read MoreIRS Lands First-Ever Crypto Tax Fraud Conviction: Ahlgren’s Case Sets Precedent

IRS Achieves Historic First in Crypto Tax Fraud Conviction In a landmark case, the IRS secured its first conviction for tax fraud involving solely cryptocurrency, setting a significant legal precedent for the industry. This development not only underscores the agency’s increasing scrutiny of crypto transactions but also signals the real-world consequences of tax evasion using […]

Read MoreTrump’s Meme Coin TRUMP Faces SEC Scrutiny and Tax Challenges

Trump’s Meme Coin Faces Legal and Tax Scrutiny In a move that’s as bold as his hair, Donald Trump has launched the TRUMP meme coin, sparking both excitement and a regulatory storm. Just before his inauguration, Trump unveiled this crypto venture, which has now come under intense legal and tax scrutiny due to its classification, […]

Read MoreIRS Unveils 2025 Crypto Tax Rules: Impact on Exchanges, ETFs, and DeFi

IRS to Implement New Crypto Transaction Reporting in 2025: What You Need to Know The Internal Revenue Service (IRS) is set to usher in a new era of crypto regulation with third-party reporting requirements starting in 2025. These changes will impact centralized and decentralized platforms, as well as Bitcoin ETF investors, aiming to enhance tax […]

Read MoreTed Cruz Challenges IRS Crypto Rules with CRA, Sparks Industry Backlash

IRS Crypto Rules Spark Pushback From Texas Senator Ted Cruz Senator Ted Cruz is gearing up for a showdown with the IRS over controversial crypto income reporting rules, signaling a major battle between government oversight and the burgeoning world of decentralized finance. Cruz challenges IRS rule on crypto income reporting using CRA. Rule expands ‘broker’ […]

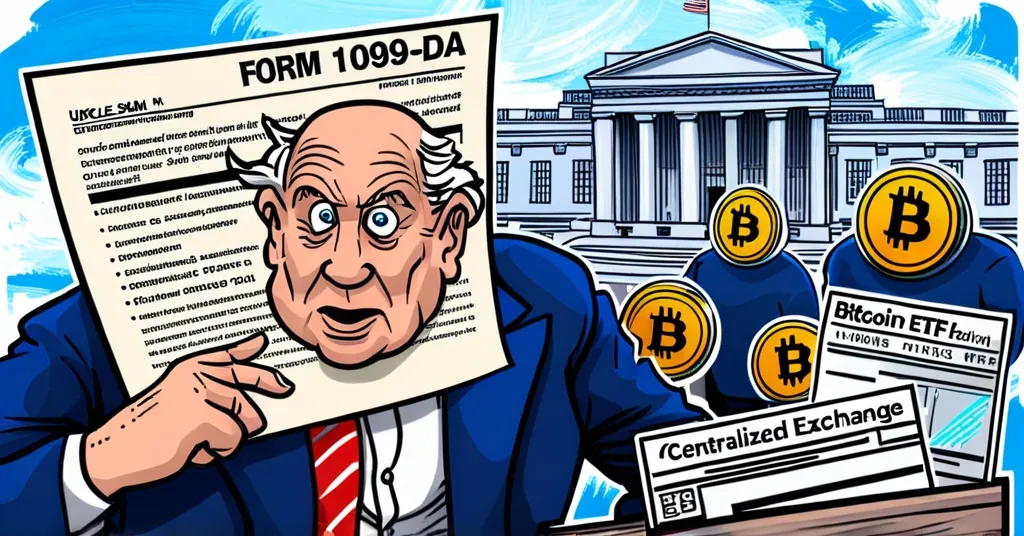

Read MoreIRS Introduces Form 1099-DA for Crypto Transactions in 2025: Impact on CEXs and ETFs

IRS Unveils New Crypto Transaction Reporting for 2025: What You Need to Know The IRS is set to introduce a new third-party reporting system for cryptocurrency transactions on centralized exchanges (CEXs) in 2025, utilizing Form 1099-DA. This move aims to enhance tax compliance but raises concerns about privacy and the nature of decentralized finance. 2025: […]

Read MoreIRS Grants Bitcoin Holders on CeFi Platforms Tax Relief Until 2025

IRS Grants Temporary Relief to Bitcoin Holders on CeFi Platforms Until 2025 The IRS has announced a temporary reprieve for Bitcoin and crypto holders on centralized finance (CeFi) platforms, providing relief from specific tax reporting rules until the end of 2025. This decision aims to ease the complexities of tax reporting challenges for cryptocurrencies on […]

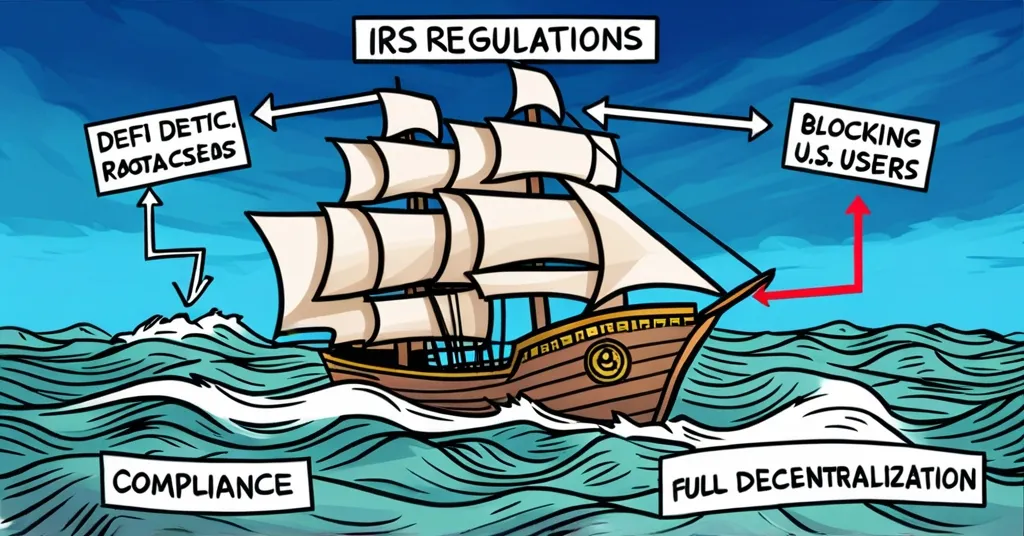

Read MoreIRS Classifies DeFi Platforms as Brokers: Navigating New Regulatory Challenges

DeFi at a Crossroads: Navigating Crypto Regulations and Compliance The future of decentralized finance (DeFi) hangs in the balance as the IRS unleashes a regulatory storm with new rules that could reshape the industry. On December 27, 2024, the IRS dropped a regulatory bombshell by classifying DeFi platforms and front-ends, the user interfaces of these […]

Read MoreBlockchain Association Sues IRS Over DeFi Broker Rules, Sparks Privacy Debate

Blockchain Association Challenges IRS Over Crypto Broker Rules The battle for the soul of decentralized finance (DeFi) has reached a boiling point as the Blockchain Association and the Texas Blockchain Council take on the IRS in a lawsuit that could redefine the future of crypto. These new regulations, set to take effect in 2027, expand […]

Read MoreIRS Targets DeFi: New 2027 Reporting Rules Impact 2.6M Taxpayers

IRS Shakes Up DeFi: New Reporting Rules Set for 2027 The Internal Revenue Service (IRS) is set to implement new regulations in 2027 that will require decentralized finance (DeFi) front-end platforms to report cryptocurrency sales and transactions. This move aims to align DeFi with traditional financial systems by extending broker reporting obligations to these platforms. […]

Read MoreCrypto Tax Rules in US, UK, EU: What 2025 Means for Investors

This is how crypto tax rules in the US, UK, and EU could impact 2025 investments Cryptocurrency’s growing mainstream presence has put it squarely in the crosshairs of tax authorities worldwide, with the US, UK, and EU stepping up their game to ensure that crypto activities contribute their fair share to public coffers. As 2025 […]

Read MoreIRS’s Crypto Staking Tax Stance Faces Legal Pushback: Jarretts’ Lawsuit Challenges Policy

IRS’s Crypto Staking Tax Policy Scrutinized as Legal Challenges Mount The IRS is under the spotlight for its unwavering stance on taxing cryptocurrency staking rewards as immediate income. This has sparked controversy and legal challenges, most notably from Joshua and Jessica Jarrett. They argue these rewards should be treated as property, taxable only upon sale, […]

Read MoreUS Initiates First Criminal Case for Crypto Tax Evasion, Signaling Regulatory Shift

US Crypto Tax Crackdown: Setting a New Precedent The US government has filed its first-ever criminal case against individuals for not paying taxes on crypto earnings. This landmark action marks a significant step in the regulation of digital currencies, highlighting the government’s commitment to ensuring tax compliance in the burgeoning crypto market. First criminal case […]

Read More