Latest News and Articles about MiCA Regulation

Malta Under Fire: ESMA Flags MiCA Compliance Issues in Crypto Hub

Malta’s Crypto Crown Slips: ESMA Scrutiny Raises MiCA Compliance Questions Malta, long celebrated as the “Blockchain Island” for its pioneering embrace of cryptocurrency, is facing a harsh reality check from the European Securities and Markets Authority (ESMA). With the EU’s Markets in Crypto-Assets (MiCA) regulation now in full swing since June 2024, ESMA’s recent review […]

Read MoreFrance’s Crypto Crackdown: 30% of Firms Silent on MiCA Deadline, Raising Alarms

France’s Crypto Clampdown: Firms Go Silent as MiCA Deadline Nears, Sparking Alarm France’s financial regulator, the Autorité des Marchés Financiers (AMF), is raising red flags as a staggering 30% of unlicensed crypto firms in the country remain tight-lipped about their plans to comply with the European Union’s Markets in Crypto-Assets (MiCA) regulation. With the July […]

Read MoreEurope’s Crypto Future: MiCA, Tokenization, and 2026 Challenges Unveiled

Crypto in Europe 2026: MiCA, Tokenization, and the Hard Road Ahead Europe’s digital asset scene is at a turning point. After a transformative 2025 packed with regulatory milestones and institutional leaps, 2026 looms as the year of truth—can the crypto industry deliver on its grand promises, or will it buckle under bureaucratic weight and global […]

Read MoreCrypto Tax Tools 2025: Best Solutions to Navigate the Global Crackdown

Navigating the Tax Trap: Best Crypto Tax Tools for 2025 Brace yourself: 2025 is set to be a brutal year for crypto investors dodging the taxman’s crosshairs. With governments worldwide tightening the screws on Bitcoin and altcoin holders, getting your taxes right isn’t just smart—it’s your ticket to avoiding audits, penalties, and a world of […]

Read MoreNordea Launches Bitcoin ETPs: A Game-Changer for European Crypto Adoption?

Nordea’s Bitcoin-Linked ETPs: A Turning Point for European Crypto Adoption A seismic shift is brewing in the Nordic financial sector as Nordea, one of the region’s banking giants, steps into the Bitcoin ring with the launch of synthetic Exchange-Traded Products (ETPs) tied to BTC’s price, set for December 2025. Partnering with CoinShares International, this move—bolstered […]

Read MoreGermany’s AfD Party Pushes for Bitcoin as Strategic Asset in Bold Political Shift

Germany’s AfD Party Demands Bitcoin Be Recognized as Strategic Asset in Bold Political Move Germany’s political arena just got a seismic jolt of crypto energy. The Alternative for Germany (AfD), a major opposition force in the Bundestag, has dropped a bombshell by pushing for Bitcoin to be classified as a “strategic asset.” Through parliamentary motions, […]

Read MoreDeutsche Börse and Circle Partner to Boost Stablecoins in European Markets

TradFi Powerhouse Deutsche Börse Teams Up with Circle for European Stablecoin Surge Europe is making waves in the digital finance arena as Deutsche Börse Group, a titan of traditional finance (TradFi), has signed a Memorandum of Understanding (MoU) with Circle Internet Financial to integrate regulated stablecoins—USDC and EURC—into the core of European capital markets. This […]

Read MoreFrance’s 2025 Crypto Rules: Paris Aims to Lead Bitcoin Revolution Amid Regulatory Risks

Crypto Regulations in France 2025: Can Paris Lead the Bitcoin Revolution or Will Red Tape Kill the Dream? France is making waves in 2025 as a potential crypto powerhouse in Europe, rolling out a regulatory framework that’s both a welcome mat for blockchain innovation and a steel gate against risks. With Bitcoin and decentralized tech […]

Read MoreBinance Pay Ignites Crypto Adoption with 80+ Merchants on French Riviera

Binance Pay Sparks a Crypto Revolution on the French Riviera: Over 80 Merchants Jump Aboard Crypto is stepping out of the digital shadows and onto the sun-drenched shores of the French Riviera. In a groundbreaking push for adoption, over 80 merchants across iconic cities like Cannes, Nice, Antibes, and Monaco are now accepting stablecoins and […]

Read MoreSparkassen to Launch Bitcoin and Ethereum Trading by 2026: A Game-Changer for Germany

Germany’s Banking Giant Sparkassen to Roll Out Bitcoin and Ethereum Trading by 2026 Germany’s financial heavy hitter, Sparkassen, has dropped a bombshell: the nation’s largest savings bank network, serving over 50 million customers, will offer Bitcoin and Ethereum trading by summer 2026. Once a fierce opponent of cryptocurrencies, this pivot signals a tectonic shift in […]

Read MoreRequest Finance Hits $1B in Transactions, Secures Funding for Stablecoin Growth

Request Finance Surpasses $1 Billion in Transactions, Secures Funding to Boost Stablecoin and Fiat Integration Can cryptocurrencies become the backbone of global business finance? Request Finance’s recent milestone of surpassing $1 billion in transactions suggests they already are. Processed over $1 billion in transactions Secured strategic funding from Bpifrance and others Acquired Consola Finance and […]

Read MoreTether’s USDT Faces Uncertainty with EU MiCA Regulations Looming

Tether Faces Regulatory Challenges Under EU MiCA Regulation Uncertainty surrounds Tether’s USDT stablecoin as the European Union gears up to enforce its Markets in Crypto-Assets (MiCA) regulation by December 30, 2023. This uncertainty is causing ripples in the crypto markets. While Coinbase has already delisted USDT out of compliance concerns, other exchanges like Binance and […]

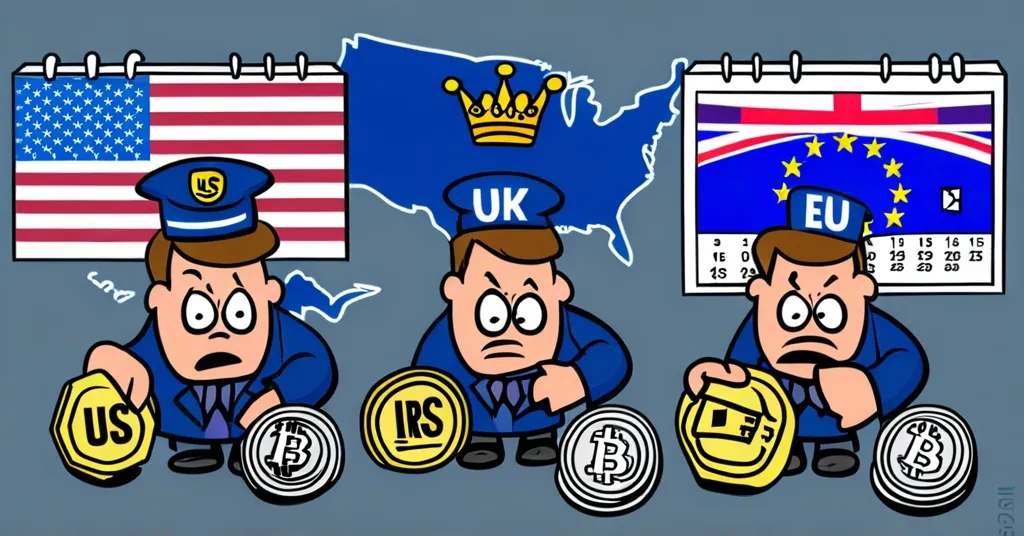

Read MoreCrypto Tax Rules in US, UK, EU: What 2025 Means for Investors

This is how crypto tax rules in the US, UK, and EU could impact 2025 investments Cryptocurrency’s growing mainstream presence has put it squarely in the crosshairs of tax authorities worldwide, with the US, UK, and EU stepping up their game to ensure that crypto activities contribute their fair share to public coffers. As 2025 […]

Read MoreGroupe BPCE to Offer Bitcoin Investments to 35 Million Customers in France by 2025

Groupe BPCE Sets the Stage: Bitcoin for Millions in France France’s banking giant, Groupe BPCE, is set to shake up the financial sector by offering Bitcoin investment services to its 35 million customers by 2025. This ambitious move not only marks a significant step for BPCE but also reflects France’s evolving regulatory approach towards cryptocurrencies, […]

Read MoreMiCA Regulation Spurs Euro-Backed Stablecoin Dominance in Europe’s Crypto Market

MiCA-Compliant Stablecoins Redefine Europe’s Crypto Market The stablecoin landscape in Europe is undergoing a significant transformation, spurred by the Markets in Crypto-Assets (MiCA) regulation. This new set of rules aims to standardize the cryptocurrency market, enhancing security and investor confidence. As MiCA takes hold, euro-backed stablecoins are becoming increasingly dominant, reshaping trading patterns and business […]

Read More