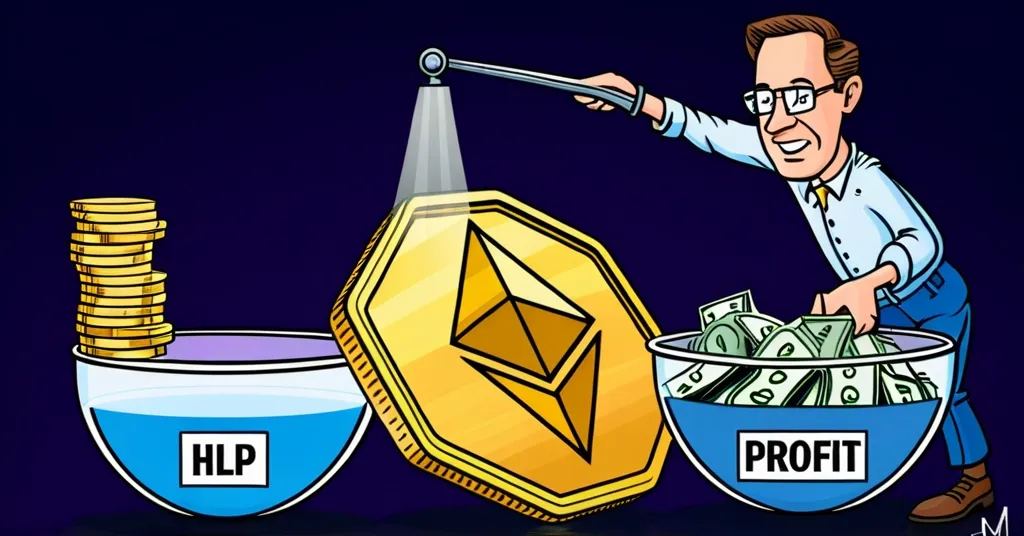

Trader Exploits Hyperliquid for $1.8M Profit, Causing $4M Loss

Hyperliquid’s $4M Loss: How a Trader Used Liquidations to Cash Out

Ever wondered how a trader can turn a $10 million stake into a $271 million position and walk away with a profit? On Hyperliquid, a savvy trader did just that, sparking a $4 million loss for the platform’s HLP vault. Let’s dive into the mechanics of this audacious move and its ripple effects across the DeFi landscape.

- Trader leverages $10M USDC into $271M ETH long

- Hyperliquid’s HLP vault suffers $4M loss

- Trader profits $1.8M on another exchange

- Hyperliquid adjusts risk parameters post-incident

The Trader’s Bold Strategy

Using $10 million in USDC, a stablecoin pegged to the US dollar, the trader crafted a leveraged position that ballooned to $271 million in Ethereum (ETH). But this wasn’t just about betting on ETH; it was about gaming the system. By strategically withdrawing collateral, the trader forced the position into liquidation, effectively dumping it onto Hyperliquid’s liquidity pool (HLP). At the same time, they shorted ETH on another exchange, likely Binance, to hedge their position and secure a $1.8 million profit as HLP’s forced selling pushed ETH prices down.

For those new to the crypto world, liquidation happens when a trader’s position is closed due to insufficient margin, often resulting in losses. Perpetual futures are financial contracts that allow traders to speculate on an asset’s price without an expiration date. Leverage magnifies potential gains or losses using borrowed funds, while liquidity pools are pools of tokens locked in a smart contract to facilitate trading on decentralized exchanges.

Hyperliquid’s Response

Hyperliquid, which boasts a dominant 70% share of the perpetual futures market according to a VanEck report, didn’t take this lying down. The platform swiftly adjusted its risk parameters, reducing maximum leverage to 40x for Bitcoin and 25x for Ethereum, and upping margin requirements to at least 20% for certain open positions. Despite the hit, HLP has been a profitable venture, generating $60 million for investors since its launch in May 2023.

Hyperliquid maintains that this incident wasn’t a traditional exploit but rather a result of market mechanics and what they call “execution slippage,” or price discrepancies during trade execution. Yet, the event has raised eyebrows and questions among crypto analysts like Three Sigma, who wonder if protocols relying on liquidations are unwittingly playing into the hands of clever traders.

“A trader turned $10 million USDC into a $271 million Ethereum long position, walked away with $1.8 million in profit, and left HLP to absorb the loss.”

Market Impact and Token Reaction

The incident sent Hyperliquid’s native HYPE token on a rollercoaster, briefly dropping 12% before recovering. This volatility reflects the high-stakes nature of DeFi and the sensitivity of token prices to platform stability and user trust.

Previous Incidents and Industry Context

This isn’t the first time HLP has been on the receiving end of such tactics. In 2023, an attacker manipulated SNX prices on centralized exchanges, resulting in a $37,000 loss for HLP. These incidents highlight the ongoing challenge for DeFi platforms to balance providing high-leverage opportunities with robust risk management.

Expert Insights and Future Implications

Crypto derivatives expert Shaurya Malwa from CoinDesk emphasized the strategic nature of the trader’s move and the urgent need for DeFi platforms to continuously refine their risk management frameworks. Olivia Chen from NFTevening views the incident as a wake-up call for Hyperliquid, suggesting that while the platform remains competitive, it must tread carefully to balance risk mitigation with maintaining its appeal to high-leverage traders.

The broader market dynamics at play here illustrate how savvy traders exploit system mechanics to their advantage. Such events not only impact the platform’s financials but also its reputation and user trust in the cutthroat DeFi arena. The adjustments to Hyperliquid’s risk parameters could influence its attractiveness to high-leverage traders, potentially affecting its market position and user base in the long run.

Counterpoints and Critical Thinking

While many might label this incident as an exploit, some argue it’s a clever use of market mechanics. Is it unethical to profit from a system’s vulnerabilities, or is it simply outsmarting the market? This event encourages us to consider whether DeFi platforms should be more transparent about their risks or if traders should bear more responsibility for understanding the intricacies of the platforms they use.

Key Questions and Takeaways

- What was the trader’s strategy on Hyperliquid?

The trader used $10 million USDC to create a $271 million ETH long position, then withdrew collateral to force liquidation, offloading the position onto HLP and profiting $1.8 million by shorting ETH on another exchange.

- How did Hyperliquid respond to the $4 million loss?

Hyperliquid adjusted risk parameters by lowering max leverage to 40x for Bitcoin and 25x for Ethereum and increasing margin requirements for large positions.

- Was the incident considered an exploit by Hyperliquid?

Hyperliquid maintained that it was not a traditional exploit but rather a result of market mechanics and execution slippage.

- What previous incident was mentioned involving HLP?

In 2023, an attacker manipulated SNX prices on centralized exchanges, exploiting HLP for $37,000.

- How did the HYPE token react to the incident?

The HYPE token briefly dropped by 12% but later recovered.

This incident with Hyperliquid underscores the ongoing tension between innovation and risk in the DeFi space. As platforms like Hyperliquid navigate these challenges, the crypto community must remain vigilant and critical, ensuring that the promise of decentralization and financial freedom doesn’t come at the cost of stability and trust.