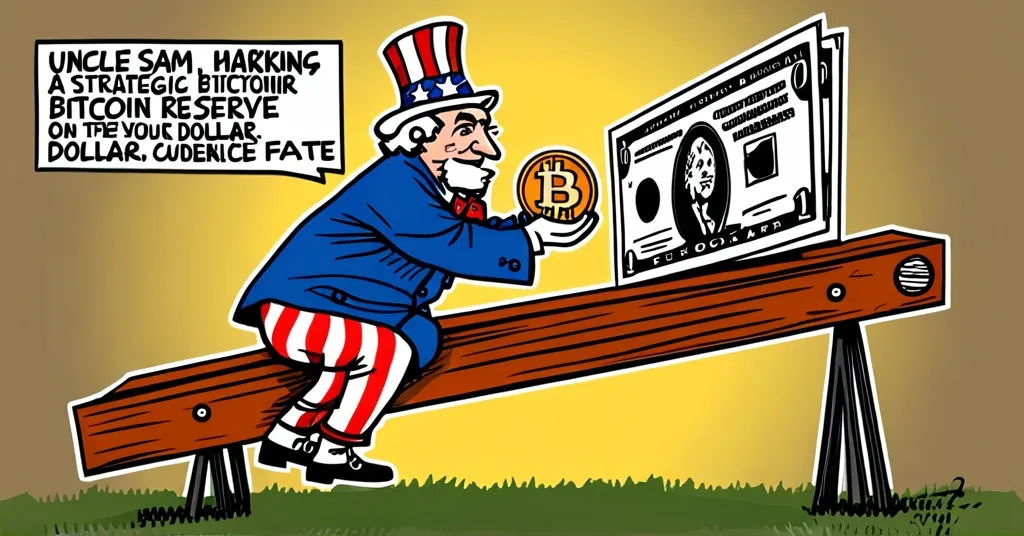

Trump’s Bitcoin Reserve Plan: Boon or Doom for the Dollar?

If Trump Creates a Strategic Bitcoin Reserve: Dollar’s Fate and Hyperbitcoinization

Donald Trump’s potential creation of a strategic Bitcoin reserve could significantly impact the US dollar and the global financial system. This bold move might either strengthen the dollar or accelerate its decline, potentially leading to hyperbitcoinization.

- Strategic Bitcoin reserve could bolster or undermine the US dollar.

- Hyperbitcoinization might render the dollar obsolete.

- Global adoption of Bitcoin reserves could reshape financial systems.

Potential Benefits

A strategic Bitcoin reserve, managed by a financial institution, could serve as a hedge against inflation. By integrating Bitcoin into the US financial system, it might stabilize the dollar and demonstrate the country’s embrace of cutting-edge financial technologies. Michael Saylor, founder of MicroStrategy, supports this idea, suggesting it could “stabilize the US economy and help pay down national debt.”

Risks and Challenges

On the flip side, hyperbitcoinization—where Bitcoin becomes the world’s leading currency—could make the dollar obsolete. As Daniel Krawisz, the term’s originator, explains, “Hyperbitcoinization is a voluntary transition to a superior currency.” If governments start holding Bitcoin, it could lead to a loss of monetary control for the US, as noted by Wu Jiezhuang, a Hong Kong legislator, who believes that “once governments start holding Bitcoin themselves, they’ll increasingly need to use it for cross-border trades, further breaking dollar hegemony.”

However, the journey to widespread adoption isn’t without hurdles. Scalability solutions like the Lightning Network are crucial for Bitcoin’s mainstream acceptance. The evolving regulatory landscape, including laws requiring businesses to verify customer identities, could impact its transition from a niche investment to a legitimate financial asset. Environmental concerns related to Bitcoin mining also pose long-term viability challenges.

Global Impact

The global adoption of Bitcoin reserves is gaining momentum, with countries like Switzerland, Germany, Hong Kong, Russia, Brazil, and Poland exploring or implementing their own. This shift could reduce reliance on the US dollar and challenge the US to adapt to new financial realities. As more nations view Bitcoin as a viable alternative, the global financial system could undergo a significant transformation.

Political Motivations and Historical Context

Trump’s consideration of a Bitcoin reserve could align with his economic policies and appeal to different voter bases. Historically, the US dollar has played a dominant role in global finance, similar to the Strategic Petroleum Reserve established in 1975 to cushion the economy against supply shocks. A strategic Bitcoin reserve could be seen as a modern equivalent, aimed at bolstering economic resilience.

State-level initiatives might precede federal action, with states like Texas, Florida, and Pennsylvania already exploring the idea. This could set the stage for a more decentralized approach to Bitcoin reserves, echoing the broader themes of freedom and decentralization that Bitcoin embodies.

Key Takeaways and Questions

- Could a strategic Bitcoin reserve strengthen the US dollar?

Yes, by integrating Bitcoin into the US financial system, it could help stabilize the dollar and combat inflation.

- What is hyperbitcoinization?

Hyperbitcoinization refers to the scenario where Bitcoin becomes the dominant global currency, potentially making national currencies like the US dollar obsolete.

- How might a Bitcoin reserve affect the US government’s control over monetary policy?

It could diminish the government’s ability to manage the money supply and respond to economic crises, as Bitcoin is decentralized.

- What risks does a Bitcoin reserve pose to the dollar?

It could signal a loss of confidence in the dollar, leading to its decline and the rise of Bitcoin as a global currency.

- How might global financial systems change if more countries adopt Bitcoin?

The adoption of Bitcoin by more countries could reshape global finance, reducing the reliance on the US dollar and challenging the US to adapt to new financial realities.

“Strategic Bitcoin Reserve can hyperbitcoinize the world. So, this can turn the dollar obsolete, and there could be just bitcoin for people like the present dollar.”

“If Bitcoin can back the US dollar, then it will be used in checking the inflationary forces that have been on a sway over that economy.”

“Once the governments start holding Bitcoin themselves, they’ll increasingly need to use it in order to settle cross-border trades, further breaking dollar hegemony.”