US Bitcoin Revolution: Lummis Pushes for Integration and Legislation

US Bitcoin Revolution Begins, Senator Lummis Says

Senator Cynthia Lummis, known as the “Bitcoin Senator,” is leading the charge to integrate Bitcoin into the U.S. economy, envisioning it as a tool for financial inclusion and a key component of decentralized financial systems.

- Lummis pushes for crypto legislation balancing innovation and regulation

- Bitcoin Act proposes Strategic Bitcoin Reserve

- 2025 predicted as pivotal year for Bitcoin

- David Sacks appointed Crypto Czar

The Vision

Senator Lummis sees Bitcoin not just as a speculative asset but as a transformative force for financial inclusion. Her vision is to utilize Bitcoin within decentralized systems (networks that operate without a central authority) to empower the unbanked population. By integrating Bitcoin into the U.S. financial system, Lummis aims to offer new financial opportunities to those traditionally excluded from the banking sector.

The Legislation

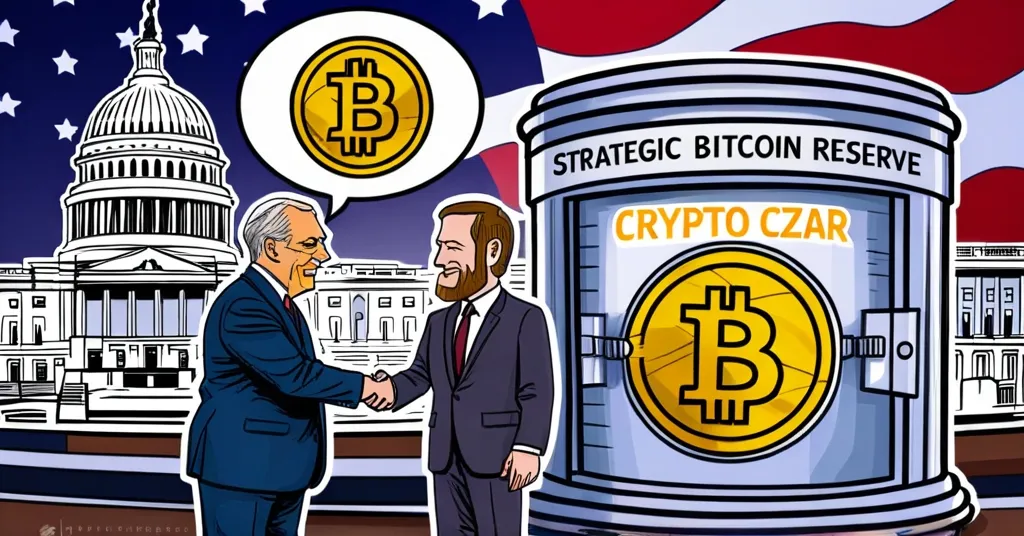

Lummis is advocating for comprehensive crypto legislation that encourages innovation while providing clear regulatory oversight. Her goal is to reduce barriers for institutional adoption, thereby facilitating Bitcoin’s mainstream integration. A central piece of her legislative efforts is the “Bitcoin Act,” officially known as the “Boosting Innovation, Technology, and Competitiveness Through Optimized Investment Nationwide Act.” This act proposes the creation of a Strategic Bitcoin Reserve, a network of secure storage vaults and programs designed to manage federal Bitcoin holdings. Think of it as a national “Bitcoin piggy bank,” where the government stashes its digital assets for future use.

Institutional Impact

Platforms like CryptoCom are targeting institutional investors, indicating a growing acceptance of Bitcoin in traditional financial circles. This institutional interest is crucial for Bitcoin’s integration into the broader financial ecosystem. CryptoCom and similar platforms are laying the groundwork for mainstream adoption by providing infrastructure and services tailored to large investors. It’s like rolling out the red carpet for Bitcoin in the world of Wall Street.

Challenges and Opportunities

While Lummis’ optimism is infectious, integrating Bitcoin into the national financial system is not without its challenges. Regulatory hurdles and potential risks associated with decentralized systems are significant concerns. Critics argue that focusing on Bitcoin as a national asset might divert attention from other pressing economic issues. However, Lummis’ efforts represent a bold step towards a more inclusive financial future. The potential to transform the financial landscape is undeniable, yet the path forward will be complex and requires a balanced approach.

The Future of Bitcoin in the U.S.

Lummis has declared 2025 as a critical year for Bitcoin, anticipating a surge in its role within the U.S. economy. This prediction is driven by proposed policies and the promise of a pro-crypto administration. A key move in this direction is the appointment of David Sacks as Crypto Czar, signaling strong governmental support for digital assets. Sacks will collaborate with Lummis to push for comprehensive digital asset legislation, further solidifying Bitcoin’s place in the U.S. financial system.

Senator Lummis expressed her enthusiasm about the future of Bitcoin, stating:

So great to meet with David Bailey. The future for Bitcoin and digital assets in America has never been brighter.

And her optimism regarding working with David Sacks:

This will be the most pro-digital asset administration ever… I am eager to collaborate with [Sacks] to ensure the successful passage of comprehensive digital asset legislation and my strategic bitcoin reserve.

While these steps forward are promising, it’s crucial to remain grounded. The journey towards a Bitcoin-integrated economy will require navigating regulatory landscapes and addressing security concerns within decentralized systems. Yet, with advocates like Senator Lummis leading the charge, the future of digital assets in the U.S. looks more promising than ever.

Key Takeaways and Questions

What is Senator Cynthia Lummis’ vision for Bitcoin in the U.S.?

Senator Lummis envisions Bitcoin as a key component of the U.S. financial system, not just as an investment but as a tool for decentralized financial systems that could help the unbanked population.

How does Lummis plan to balance innovation and regulation in the crypto space?

Lummis aims to create legislation that fosters innovation while providing transparent oversight, reducing barriers for institutional adoption and encouraging mainstream financial integration.

What role does institutional interest play in Bitcoin’s future?

Growing institutional interest, exemplified by platforms like CryptoCom targeting institutional investors, is crucial for Bitcoin’s integration into the broader financial ecosystem.

What is the significance of the year 2025 for Bitcoin according to Lummis?

Lummis predicts 2025 will be a critical year for Bitcoin due to proposed policies and a shift towards a pro-crypto administration.

What is the “Bitcoin Act” and what does it propose?

The “Bitcoin Act,” officially the “Boosting Innovation, Technology, and Competitiveness Through Optimized Investment Nationwide Act,” proposes the establishment of a Strategic Bitcoin Reserve to manage federal Bitcoin holdings through secure storage vaults and other programs.

Who is David Sacks and what is his role in the crypto landscape?

David Sacks has been appointed as Crypto Czar, indicating a pro-crypto stance from the administration. He will collaborate with Lummis to push for comprehensive digital asset legislation.