US Congressman Proposes Bill to Safeguard Trump’s Bitcoin Reserve

US Congressman To Introduce New Crypto Bill Protecting Trump’s Strategic Bitcoin Reserve

US Congressman Byron Donalds is set to introduce a bill on March 14 to codify President Donald Trump’s Strategic Bitcoin Reserve (SBR), a move that could solidify Bitcoin’s role as a national strategic asset.

- Bill to protect Trump’s SBR proposed by Byron Donalds.

- SBR and Digital Asset Stockpile to be funded by seized crypto.

- Faces opposition from Democrats on fiscal and ethical grounds.

- Potential global implications for the US’s crypto stance.

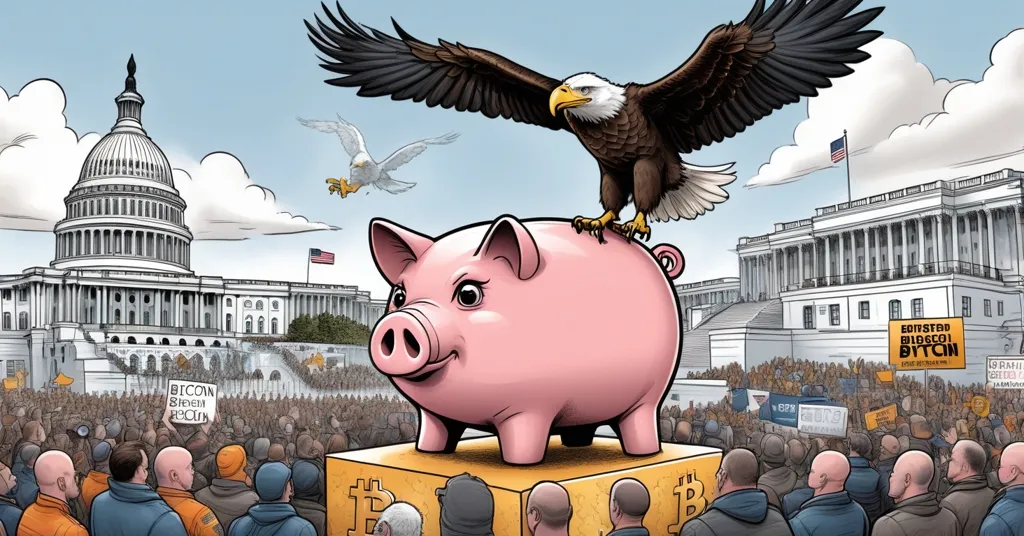

Bitcoin’s journey from a niche digital currency to a potential national strategic asset is a testament to its growing influence. The SBR, akin to a digital piggy bank, is President Trump’s brainchild, meant to be managed by the US Department of the Treasury and funded by Bitcoin and other digital currencies seized from criminal and civil forfeiture proceedings. This includes the US government’s impressive 200,000 BTC holdings, a stash that could make any crypto enthusiast drool.

On March 6, Trump’s executive order set the stage for this ambitious plan, aiming to establish not only the SBR but also a U.S. Digital Asset Stockpile. The latter, as Trump announced on Truth Social, would include other digital assets like Ethereum, XRP, Solana, and Cardano, expanding the scope of the nation’s digital asset strategy.

Congressman Donalds is stepping up to the plate with the “Reserve and Stockpile Act,” a legislative effort to protect Trump’s initiative from future administrations that might want to hit the undo button. “The Democrats waged a war on the crypto industry and it is time for Congressional Republicans to decisively end it,” Donalds declared, drawing clear battle lines in the ongoing political tussle over cryptocurrencies.

Republican support for the SBR is robust, with Senator Cynthia Lummis reintroducing her reserve bill, co-sponsored by Senators Justice, Tuberville, Marshall, Blackburn, and Moreno. Her legislation includes a 1-million-unit Bitcoin purchase program, aiming to position the US as a leader in the digital economy. “Landmark legislation that will codify President Trump’s bold vision to establish the United States Strategic Bitcoin Reserve and strengthening our nation’s economic foundation for generations to come,” Lummis stated, echoing the optimism of her party.

However, the path to legislative success is fraught with political landmines. The bill needs at least 60 votes in the Senate and a House majority to pass. Meanwhile, Representative Nick Begich introduced a companion bill to Lummis’ legislation, emphasizing the urgency of maintaining US leadership in the digital realm. “America cannot afford to fall behind in this financial revolution,” Begich warned, highlighting the stakes involved.

Yet, not everyone is singing from the same hymn sheet. Democratic Representative Gerry Connolly has emerged as a vocal critic, arguing that the SBR is nothing more than a “get rich quick scheme” for Trump and his cronies. In a scathing letter to Treasury Secretary Scott Bessent, Connolly laid out his concerns: “Such a reserve provides no discernible benefit to the American people but would significantly enrich the President and his donors. It would also constitute unsound fiscal policy by picking winners among currencies via social media and wasting taxpayer dollars.”

Connolly’s critique raises valid points about fiscal responsibility and potential conflicts of interest, particularly given Trump’s ownership in World Liberty Financial and the $TRUMP memecoin. These ties add a layer of complexity to the debate, making it more than just a partisan squabble over digital assets.

As Bitcoin continues to trade at around $83,366, the introduction of the SBR and related legislation could have far-reaching implications for the market. It might boost public confidence in Bitcoin, potentially driving up its adoption and price. But let’s not kid ourselves—crypto markets are as predictable as a roulette wheel on a stormy day.

The global perspective adds another dimension to the SBR debate. Countries like El Salvador have already embraced Bitcoin as legal tender, positioning themselves at the forefront of the crypto revolution. Will the US’s move with the SBR encourage other nations to follow suit, or will it trigger a new era of economic competition? The geopolitical chess game is just heating up.

Technologically, managing a national Bitcoin reserve isn’t a walk in the park. The BITCOIN Act, introduced by Senator Lummis, aims to ensure transparent management of Bitcoin holdings and offset costs using Federal Reserve resources. It’s a complex undertaking that requires robust security measures and a keen understanding of blockchain technology.

In the long run, the SBR could serve as a hedge against inflation and bolster the US dollar, aligning with the broader Republican vision of making America the “crypto capital of the world.” But let’s not forget the potential pitfalls—unintended market distortions, regulatory challenges, and the ever-present risk of corruption.

The SBR debate is more than just a political football; it’s a crucial moment in the ongoing saga of cryptocurrencies. As we navigate this new frontier, it’s essential to keep an eye on both the promise and the perils of digital assets. After all, in the world of crypto, the only constant is change.

Key Takeaways and Questions

What is the Strategic Bitcoin Reserve (SBR)?

The SBR is a national reserve of Bitcoin, akin to a piggy bank for digital currency, proposed by President Trump and managed by the US Department of the Treasury, funded by seized crypto assets.

What is the purpose of the new bill by Representative Byron Donalds?

The bill aims to codify Trump’s executive order for the SBR, ensuring its longevity beyond future administrations.

Who are the key figures supporting the SBR?

Supporters include Representatives Byron Donalds and Nick Begich, and Senator Cynthia Lummis, along with several Republican co-sponsors.

What is the opposition’s main argument against the SBR?

Led by Representative Gerry Connolly, the opposition argues that the SBR would primarily benefit Trump and his donors while being fiscally unsound.

How is the SBR proposed to be funded?

The SBR is set to be funded by cryptocurrencies seized during government proceedings, including the US’ existing 200,000 BTC holdings.

What is the BITCOIN Act and its goals?

The BITCOIN Act seeks to ensure transparent management of Bitcoin by the Federal Government and offset costs using Federal Reserve resources.

What political dynamics are at play regarding the SBR?

Republicans view the SBR as a way to maintain US leadership in the digital economy, while Democrats oppose it, citing concerns about fiscal responsibility and potential conflicts of interest.