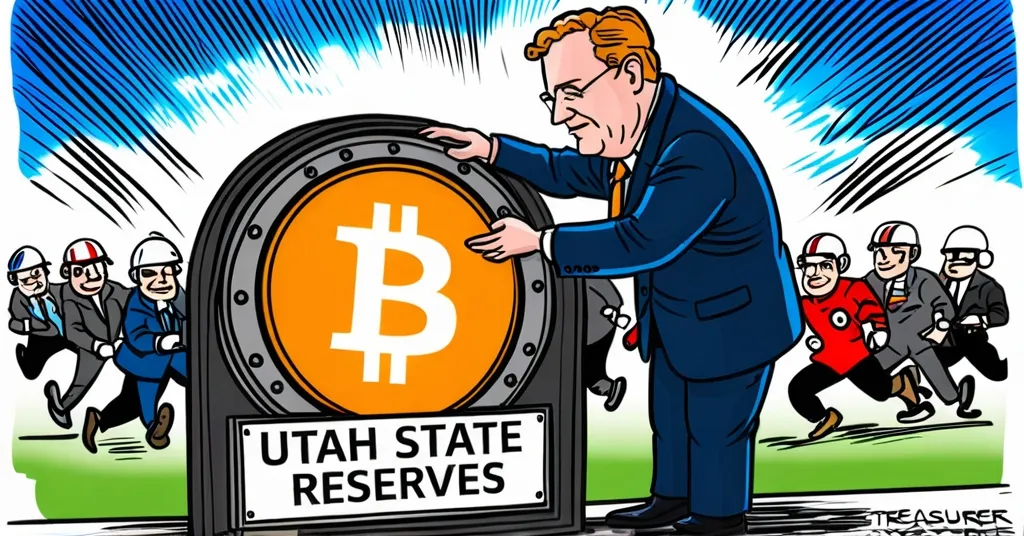

Utah’s HB230 Advances: Bitcoin Set to Become State Reserve Asset

Utah’s Bold Leap into Bitcoin: House Bill 230 Advances

Could Bitcoin soon become a staple in state treasuries across the US? Utah’s Senate Revenue and Taxation Committee has taken a significant step toward that reality, passing House Bill 230 (HB230) with a 4-2-1 vote. This move marks a pivotal moment in the state’s journey to potentially establish Bitcoin as a strategic reserve asset.

- HB230 passes Senate committee with 4-2-1 vote

- Utah state treasurer can invest up to 5% of reserve funds in digital assets

- Bitcoin is the only asset currently meeting the bill’s market cap criteria

- Bill awaits further Senate readings and governor’s signature

Details of House Bill 230

HB230, officially titled “Blockchain and Digital Innovation Amendments,” allows the Utah state treasurer to invest up to 5% of certain public reserve funds, amounting to approximately $1.4 billion, in digital assets. This bill is the latest development from the Blockchain Digital Innovation Task Force, aimed at protecting and regulating digital assets and blockchain technology.

“HB230 is the latest iteration out of the Blockchain Digital Innovation Task Force. [It ensures] how digital assets and blockchain is protected and how the government would treat that and ensuring that there aren’t undue prohibitions or restrictions on blockchain. […] the bill also allows for some very limited investments, initial investments by the state treasurer in digital assets and some requirements around how that’s kept in custody.” – Rep. Jordan Teuscher

Eligibility Criteria

The bill sets a high bar for digital assets, requiring a minimum average market capitalization of $500 billion over the past 12 months. Currently, Bitcoin is the only cryptocurrency that meets this criterion, making it the sole eligible asset for investment under HB230. Market capitalization, or “market cap,” refers to the total value of all the cryptocurrency in circulation, a measure of its overall size and stability. You can check Bitcoin market capitalization trends over the past 12 months to see how it compares to the bill’s requirements.

“That includes that those qualifying digital assets are only those with a market cap of over $500 billion […] and limiting the funds that could be invested in that into just the four funds […], which are some of the rainy day funds in the state.” – Rep. Jordan Teuscher

Broader Legislative Trends

Utah’s move places it at the forefront of what’s being called the Bitcoin Reserve Race, with 26 other US states currently pursuing similar legislation. This trend reflects a growing interest in integrating cryptocurrencies into state financial strategies. At the federal level, initiatives like the BITCOIN Act, introduced by Sen. Cynthia Lummis, aim to establish a federal strategic Bitcoin reserve, indicating a national shift toward recognizing cryptocurrencies as viable financial assets.

Risks and Criticisms

While the optimism surrounding Bitcoin’s potential as a strategic reserve is palpable, it’s crucial to acknowledge the risks and challenges. Critics argue that such investments could be volatile and speculative, potentially jeopardizing state funds. They claim it’s a risky gamble with taxpayer money, but they fail to see the bigger picture. Proponents like Rep. Teuscher and the Blockchain Digital Innovation Task Force believe in the long-term potential and the need for a regulatory framework that balances innovation with oversight. For further discussion on the topic, see HB230 Bitcoin investment discussion on Reddit.

Future Implications

HB230’s passage could shake up traditional finance, forcing other states to take note or get left behind. From a Bitcoin maximalist perspective, this bill underscores Bitcoin’s dominance and potential as a store of value. It could pave the way for more widespread adoption and acceptance of cryptocurrencies, not just as speculative assets but as legitimate components of state financial strategies. The potential impact of this legislation is further discussed in analyses on Utah Bitcoin reserve legislation.

The bill also includes provisions for crypto staking, which involves holding cryptocurrencies to support the operations of a blockchain network and earning rewards in return. This aspect could open the door for future investments in other high-cap proof-of-stake cryptocurrencies like Ethereum, adding another layer of financial innovation. For insights into why states are interested in such moves, see Digital Assets as state reserves discussion on Quora.

Key Questions and Takeaways

- What is the purpose of House Bill 230 in Utah?

The purpose of House Bill 230 is to allow the Utah state treasurer to invest up to 5% of certain public reserve funds in digital assets, primarily Bitcoin, as a strategic reserve asset.

- What criteria must a digital asset meet to be eligible for investment under HB230?

Eligible digital assets must have a minimum average market capitalization of $500 billion over the past 12 months, a criterion currently met only by Bitcoin.

- How many US states currently have active Strategic Bitcoin Reserve bills?

26 US states currently have active Strategic Bitcoin Reserve bills.

- What is the next step for HB230 after passing the Senate Revenue and Taxation Committee?

The next steps for HB230 include further Senate readings and a final vote, followed by the need for Governor Spencer Cox’s signature to become law.

- What additional provision does HB230 include besides investment in Bitcoin?

HB230 also allows the state treasurer to engage in crypto staking, which could include other high-cap proof-of-stake cryptocurrencies in the future.

- What is the significance of Utah’s move in the context of the broader US legislative landscape regarding cryptocurrencies?

Utah’s move places it at the forefront of the Bitcoin Reserve Race, reflecting a trend where states are exploring the potential of cryptocurrencies as strategic reserve assets, amidst varied legislative efforts across the US. For more on this, see Strategic Bitcoin Reserve bills in US states.

Utah’s foray into Bitcoin investment through HB230 is a bold step that could set a precedent for other states. Whether this marks the beginning of a new era in state-level financial strategy or a cautionary tale remains to be seen, but one thing is clear: the conversation around Bitcoin and its role in our financial future is far from over.