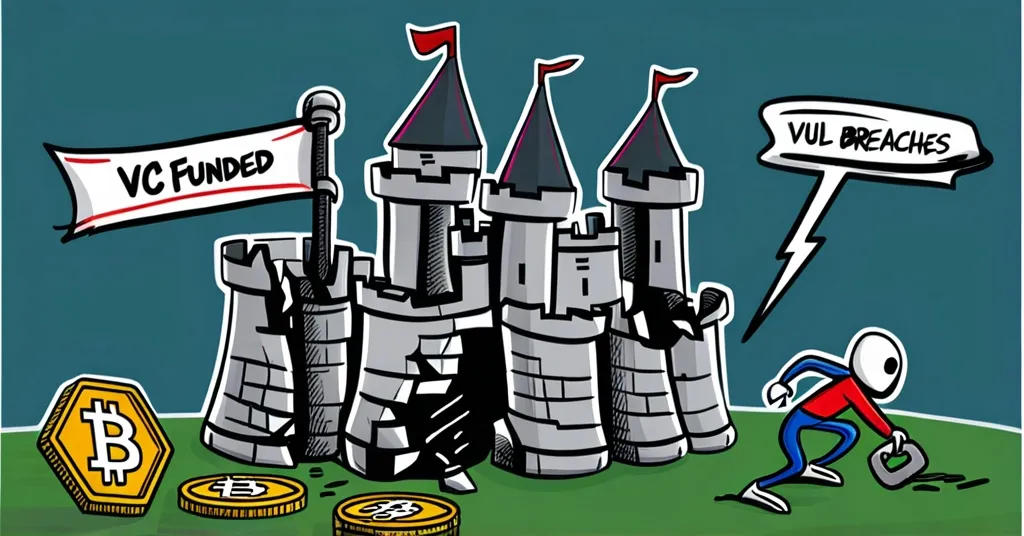

VC-Backed Blockchain Projects: Funding Doesn’t Guarantee Security

Does VC-Backed Equal VC-Secure? Understanding Blockchain Security in the Crypto World

The crypto world has been shaken by several high-profile security breaches in venture capital (VC)-backed blockchain projects. These incidents expose the dangerous myth that substantial funding guarantees impregnable security.

- WazirX’s $235 million loss due to a multi-signature wallet vulnerability

- Radiant Capital’s $57.5 million hit from flash loan and multisig exploits

- Playdapp’s staggering $290 million theft via private key exploits

- Hedgey Finance’s $2 million smart contract vulnerability

- The Munchables’ $62.5 million loss from a compromised upgradable proxy contract

WazirX Security Breach: A $235 Million Lesson

In July 2024, WazirX, a major Indian exchange platform, suffered a devastating blow when the Lazarus Group, hackers linked to North Korea, exploited a vulnerability in their multi-signature wallet. A multi-signature wallet, or “multisig,” requires multiple private keys to authorize a transaction, aimed at enhancing security. However, the Lazarus Group managed to siphon off $235 million in assets, including significant amounts of Shiba Inu, Ether, Matic, and Pepe. WazirX, with $2.9 million in investments from tech-focused VCs like Kalaari Capital, was forced to temporarily suspend withdrawals. The fallout was immediate, with rival company CoinSwitch suing over the lost funds. This incident is a harsh reminder that even with substantial VC backing, security can be compromised.

Radiant Capital’s Double Hit: Flash Loans and Malware

Radiant Capital, a DeFi protocol, faced not one but two attacks in October 2024. A flash loan attack, where an attacker borrows funds without collateral to manipulate the market, drained $4.5 million. The second attack was more devastating, using malware and blind signing to exploit their 3-of-11 multi-signature wallet, resulting in a $53 million loss. Despite securing $12.3 million in funding, Radiant Capital’s complex security measures backfired when attackers manipulated the signers. This case highlights the importance of rigorous monitoring and implementation of security protocols.

Playdapp’s $290 Million Nightmare

In February 2024, Playdapp, a South Korean gaming platform, fell victim to private key exploits, leading to a staggering $290 million theft. Despite raising $3.8 million, Playdapp’s focus on funding rounds overshadowed the need for robust security measures. Private key exploits occur when attackers gain access to the private keys needed to authorize transactions, underscoring the critical need for safeguarding these keys.

Hedgey Finance’s Smart Contract Vulnerability

Hedgey Finance, a DeFi token vesting platform, raised funds from 13 different funds but lost $2 million due to a smart contract vulnerability in April 2024. Smart contracts are self-executing contracts with the terms directly written into code. However, even a small vulnerability in the code can lead to significant financial losses, emphasizing the need for thorough testing and audits.

The Munchables’ $62.5 Million Loss

The Munchables, a Web 3.0 gaming platform, lost $62.5 million in March 2024 due to a compromised upgradable proxy contract. An upgradable proxy contract allows for updates to the contract’s logic without changing its address. However, this feature became a vulnerability when exploited, highlighting the importance of securing every aspect of a project’s architecture.

The VC-Backed Myth

The misconception that VC backing inherently ensures a project’s security is a dangerous one. Dmitry Mishunin from HashEx Blockchain Security notes:

It’s common to assume that if a project is good enough for a venture fund, it must be good enough for a user.

However, these incidents tell a different story. Mishunin adds:

Sadly, money does not always equal security, and some users had to find that out the hard way.

Despite having access to powerful mechanisms, ‘money people’ are not usually experts in Web 3.0 security. Vulnerabilities, especially those that end in financial tragedy, often lead to a loss of financing.

Strengthening Security: A Call to Action

The key to navigating this minefield is thorough security audits. Multiple audits from reputable companies, constant communication with auditors, and the serious implementation of their recommendations are non-negotiables. Mishunin’s framework for smart contract audits provides a structured approach to identifying and mitigating common vulnerabilities, emphasizing the importance of economic models and the limitations of audits.

In the realm of blockchain, where decentralization and privacy reign supreme, it’s vital to champion the cause of security with the same fervor we reserve for innovation. While VC money can fuel the fire of development, it’s the diligence in security practices that keeps the flames from consuming the entire edifice.

As we embrace the principles of effective accelerationism (e/acc) and strive to disrupt the status quo, let’s remember that the path to a decentralized future is paved with both opportunity and pitfalls. The stories of WazirX, Radiant Capital, Playdapp, Hedgey Finance, and The Munchables serve as grim reminders that while VC backing is a vote of confidence, it’s not a shield against the relentless hackers and vulnerabilities that lurk in the shadows of cyberspace.

Key Takeaways and Questions

What does the relationship between VC funding and project security really look like?

There’s no direct correlation between VC funding and the security of a project. While financial support is crucial, it doesn’t guarantee robust security, as evidenced by the numerous well-funded projects that have suffered significant losses due to security breaches.

How can blockchain projects improve their security?

Blockchain projects can bolster their security by conducting thorough and multiple audits from reputable security firms, researching potential auditors, and maintaining constant communication to implement their recommendations. Early-stage audits are essential to prevent vulnerabilities from being exploited.

What are some common types of security vulnerabilities in blockchain projects?

Common security vulnerabilities include multi-signature wallet issues, flash loan attacks, private key exploits, and smart contract vulnerabilities. These have led to significant financial losses across various projects.

Why is it crucial for the blockchain industry to address security concerns?

Addressing security concerns is vital for the blockchain industry because vulnerabilities not only lead to financial losses but also damage the industry’s reputation. This can deter potential investors, developers, and participants, hindering the growth and adoption of blockchain technology.

What are the long-term implications of these security breaches?

These breaches can lead to increased regulatory scrutiny, a shift in investor behavior towards more cautious funding, and a push for standardized security practices across the industry. They highlight the need for ongoing vigilance and the development of more robust security protocols.