Vitalik Buterin’s Disappointment Sparks Ethereum’s Strategic Overhaul

Vitalik Buterin’s Disappointment and Ethereum’s Strategic Vision

In a recent AMA session, Ethereum co-founder Vitalik Buterin shared his most disappointing moment, sparking a deeper look into Ethereum’s future strategy and its role in the broader crypto ecosystem.

- Buterin’s disappointment over casino criticisms

- Commitment to Ethereum community

- Strategic shifts for Ethereum

- Contrasting approaches with Solana

- Scalability and economic model enhancements

Vitalik Buterin expressed frustration with criticisms labeling Ethereum as intolerant due to its cautious stance on blockchain-based casinos. He voiced his disappointment, stating,

Perhaps the most disappointing thing for me recently was when someone said that Ethereum is bad and intolerant because we don’t respect the ‘casinos’ on the blockchain enough, and other chains are happy to accept any application, so they are better.

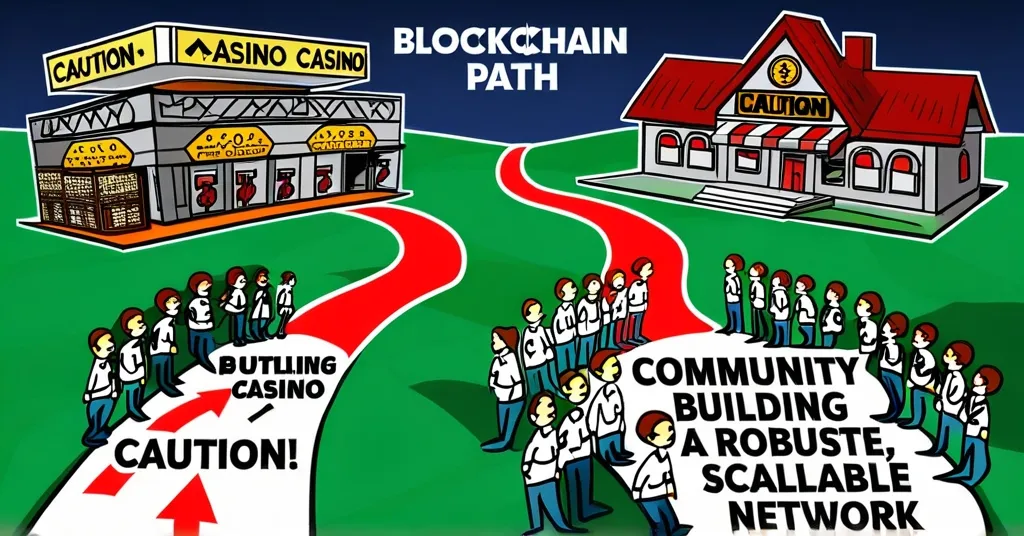

This criticism highlights a broader debate within the crypto community about balancing open access with ethical considerations. Buterin’s reluctance to fully embrace gambling on the blockchain underscores Ethereum’s commitment to fostering a sustainable and responsible ecosystem.

Despite the disappointment, Buterin’s dedication to the Ethereum community remains firm. He emphasized,

I have a responsibility to this community and cannot abandon them. We Ethereum need to work together to create the world we want to see.

His unwavering commitment is crucial as Ethereum navigates its path forward, striving to uphold its foundational principles of decentralization and innovation.

To align Ethereum with its long-term vision, Buterin proposed strategic shifts. These include making the system more open and less controlled by a few, which he refers to as structural improvements and greater decentralization within the Ethereum Foundation. He noted,

This will require some changes. But this project is worth doing.

These changes could mean moving away from neutrality at the application layer, potentially reshaping Ethereum’s governance and operational model. This shift towards less neutrality is a bold move, but one that could better align Ethereum with its core principles of decentralization.

Ethereum’s approach differs significantly from more permissive networks like Solana, which have embraced a broader range of applications, including gambling and speculative ventures. Buterin highlighted the risks of such openness by referencing the collapse of LIBRA on Solana, which wiped out $4.5 billion in investor funds. He pointed out that while Solana’s permissiveness might attract a larger volume of applications, it also exposes users to significant risks. This example serves as a cautionary tale about the dangers of prioritizing rapid growth over responsible governance.

Ethereum’s focus remains on long-term sustainability and innovation, attracting institutional interest. For instance, giants like BlackRock have launched tokenized investment funds on Ethereum, signaling confidence in its future. To support this vision, Ethereum is enhancing its scalability through Layer 2 solutions, which are technologies designed to process transactions faster and cheaper. The upcoming Pectra update, combining Prague and Electra, aims to achieve 100,000 transactions per second (TPS). This upgrade will introduce account abstraction, allowing for more flexible gas payments, smart contract optimizations for better performance, and improved staking options to make Ethereum more user-friendly.

Buterin also proposed adjustments to Ethereum’s economic model, advocating for ETH to serve as a “triple point asset” – functioning as a means of exchange, a consumable product, and a store of value. He suggested incentivizing Layer 2 projects, optimizing rollup revenue structures, and adjusting BLOB pricing strategies to strengthen Ethereum’s economic position. These economic adjustments aim to create a more robust and sustainable ecosystem, aligning with Buterin’s vision for Ethereum’s future.

While Ethereum’s cautious approach may invite criticism, Buterin’s vision is clear: prioritize decentralization, innovation, and sustainability over short-term gains. As Ethereum continues to evolve, these strategic shifts could pave the way for a more robust and ethical blockchain ecosystem. However, playing devil’s advocate, one could argue that this cautious approach might hinder innovation or adoption compared to more permissive networks. Additionally, Bitcoin maximalists might view Ethereum’s strategic shifts as an attempt to compete in a space where Bitcoin has already established dominance, questioning the necessity of such changes.

Ethereum’s evolution aligns with the philosophy of “effective accelerationism” (e/acc), which emphasizes rapid technological progress to drive societal change. By focusing on scalability, decentralization, and economic sustainability, Ethereum is positioning itself at the forefront of this movement, aiming to disrupt the status quo and champion freedom and privacy in the financial sector.

Key Takeaways and Questions

- What was Vitalik Buterin’s most disappointing moment for Ethereum?

Vitalik Buterin’s most disappointing moment was when Ethereum was criticized for being intolerant due to its cautious approach towards blockchain-based casinos.

- How does Buterin feel about his responsibility to the Ethereum community?

Buterin feels a strong responsibility to the Ethereum community and believes in working together to create the desired future.

- What strategic shifts did Buterin suggest for Ethereum?

Buterin suggested making the system more open and less controlled by a few, potentially moving away from neutrality at the application layer.

- How does Ethereum’s approach differ from Solana’s?

Ethereum focuses on decentralization, innovation, and long-term sustainability, while Solana takes a more permissive approach, welcoming a broader range of applications including gambling and speculative ventures.

- What are the risks associated with Solana’s approach?

Solana’s openness to various applications has led to high-profile failures such as the collapse of LIBRA, which wiped out $4.5 billion in investor funds.

- What is Ethereum doing to enhance its scalability?

Ethereum is focusing on scalability through Layer 2 solutions, with upcoming upgrades like the Pect