Meta Urged to Hedge $72B Cash with Bitcoin Amid Inflation Fears

Bitcoin Treasury Proposal Urges Meta to Hedge Against Inflation

Ethan Peck, a shareholder advocate from the National Center for Public Policy Research, has put forth a proposal urging Meta to allocate a portion of its large $72 billion cash reserves into Bitcoin as a hedge against inflation.

- Proposal to hedge Meta’s cash reserves with Bitcoin

- Citing potential 28% loss due to inflation

- Bitcoin’s superior performance against bonds

Peck’s argument is clear: with inflation potentially eroding Meta’s cash assets by up to 28%, Bitcoin offers a robust defense. Over the past five years, Bitcoin has outperformed bonds by over 1,200%, proving its potential as a store of value. A store of value is an asset that can be saved, retrieved, and exchanged at a later time, maintaining or increasing in value. This proposal isn’t just about chasing numbers; it’s about shielding Meta’s financial future from the corrosive effects of inflation. An inflation hedge protects money from losing value over time due to inflation.

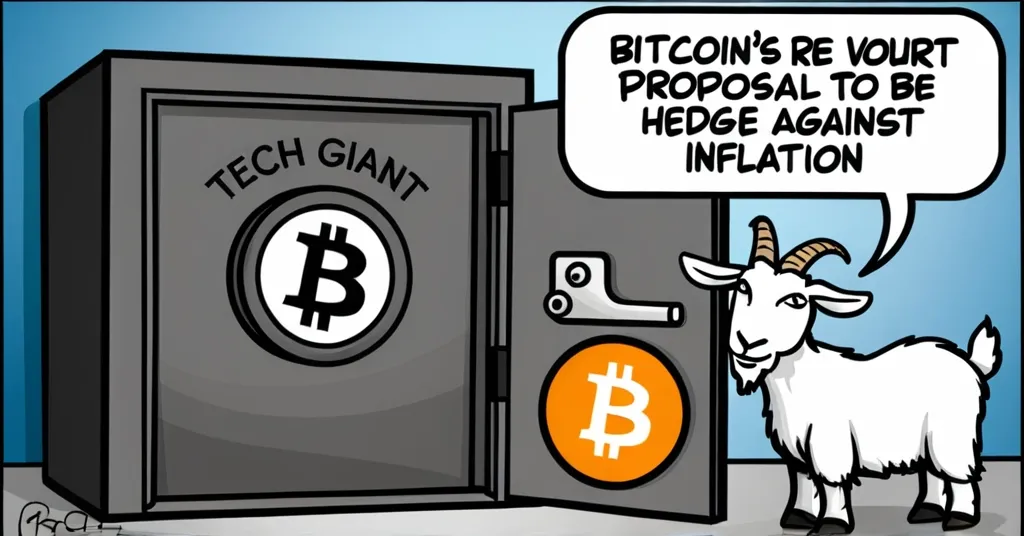

The proposal gains an interesting angle with personal anecdotes from Meta’s leadership. Mark Zuckerberg named his goats ‘Bitcoin’ and ‘Max.’ Seems like even the goats are in on the crypto game! Meta director Marc Andreessen has publicly praised Bitcoin and serves as a director at Coinbase. Peck doesn’t miss the opportunity to draw a connection:

Mark Zuckerberg named his goats ‘Bitcoin’ and ‘Max.’ Meta director Marc Andreessen has praised Bitcoin and is also a director at Coinbase. Do Meta shareholders not deserve the same kind of responsible asset allocation for the Company that Meta directors and executives likely implement for themselves?

This isn’t the first such proposal from the National Center for Public Policy Research. They previously tried to steer Microsoft and Amazon towards similar strategies in 2024, but without success. Microsoft shareholders rejected the proposal outright in December 2024, while Amazon’s decision awaits in April 2025. The outcomes of these proposals can be found here.

Adding weight to Peck’s proposal, BlackRock, Meta’s second-largest institutional shareholder, recommended a 2% BTC allocation. This endorsement from a financial giant reflects the growing institutional interest in Bitcoin as a viable asset class. However, BlackRock also cautions about Bitcoin’s volatility and correlation to other assets, emphasizing the need for careful consideration. More details on BlackRock’s recommendation can be found here.

Despite the compelling case for Bitcoin, tech firms remain cautious. The volatility of Bitcoin is the elephant in the room, deterring many from taking the plunge. Yet, as Peck argues, the true inflation rate might be double the Consumer Price Index (CPI), making traditional cash reserves increasingly risky.

Moving beyond Meta, the broader trend of institutional interest in Bitcoin is evident. MicroStrategy’s successful Bitcoin strategy has led to its stock outperforming tech giants like Microsoft and Amazon. The launch of Bitcoin-related exchange-traded products, such as BlackRock’s iShares Bitcoin Trust now holding over $51 billion in assets, further cements institutional appetite for Bitcoin.

However, it’s not all sunshine and rainbows in the crypto world. The cautionary tale of Wolf Capital’s co-founder pleading guilty to a $9.4 million Ponzi scheme serves as a stark reminder that while Bitcoin offers potential rewards, the crypto space is rife with fraudsters looking to exploit newcomers. No bullshit, folks—the crypto space can be a wild west, and it’s crucial to stay vigilant.

The convergence of blockchain and AI, as seen with the 0G Foundation’s $30 million node sale, hints at broader technological trends that could intersect with Bitcoin’s adoption. This forward-looking perspective underscores the potential for Bitcoin to be more than just a hedge—it could be a pivotal part of the future of finance.

Yet, the journey ahead is fraught with challenges. Regulatory concerns, such as potential crackdowns on Bitcoin mining due to its environmental impact, loom large. While Bitcoin maximalists advocate for its role as the ultimate store of value, it’s important to acknowledge that other cryptocurrencies and blockchains, like Ethereum, play crucial roles in filling niches that Bitcoin may not serve.

In a world where decentralization and financial freedom are championed, the proposal to Meta is a bold step. It aligns with the principles of effective accelerationism (e/acc), pushing the boundaries of traditional finance. Yet, the proposal hangs in the balance, with the crypto community watching closely, hopeful yet aware of the complexities at play. Discussions on this proposal can be found on Reddit.

Key Takeaways and Questions

- What is the main purpose of Ethan Peck’s proposal to Meta?

The main purpose is to hedge part of Meta’s $72 billion cash reserves against inflation by allocating funds into Bitcoin.

- How has Bitcoin performed as a store of value compared to bonds?

Over the past five years, Bitcoin has outperformed bonds by over 1,200%. You can see more details on Bitcoin’s performance.

- Why might tech firms be hesitant to adopt Bitcoin as part of their treasury strategy?

Tech firms are hesitant due to Bitcoin’s volatility, which they perceive as a risk to their cash reserves.

- What was the outcome of similar proposals submitted to Microsoft and Amazon?

Microsoft shareholders rejected a similar proposal in December 2024. The outcome of the Amazon proposal will be announced in April 2025.

- What is the significance of BlackRock’s recommendation in the context of the proposal?

BlackRock’s recommendation of a 2% BTC allocation adds credibility to the proposal, given their position as Meta’s second-largest institutional shareholder. You can find more information on Quora.

- What alternative measure of inflation does the National Center for Public Policy Research suggest?

They suggest that the true inflation rate is double the Consumer Price Index (CPI).

- How does the personal interest of Meta’s leadership in Bitcoin relate to the proposal?

It suggests that if Meta’s leadership believes in Bitcoin personally, they should consider similar asset allocation for the company’s benefit. More on this can be found here.