Latest News and Articles about BlackRock

BlackRock’s Bitcoin ETF Outshines S&P 500: Are Altcoins Next for Wall Street?

Wall Street’s Bitcoin ETF Breakthrough: Are Altcoins the Next Big Bet? BlackRock has just flipped the financial world on its head: its spot Bitcoin ETF, known as iBIT, is now pulling in more annual fee revenue than its S&P 500 ETF, IVV. With $186 million versus $183 million, this isn’t just a stat—it’s a glaring […]

Read MoreBitcoin Bull Market 2025: Institutional Power Reshapes Crypto Dynamics

Why This Bitcoin Bull Market Feels Different: Institutional Dominance Reshapes 2025 Bitcoin is hovering around $104,400, yet this bull market doesn’t carry the same chaotic energy as past cycles. Crypto pundit Luca has cut through the noise with a stark observation: we’re not in just another hype-driven rally; we’re witnessing a structural overhaul, a new […]

Read MoreBlackRock’s IBIT Surges to $71B as Institutional Bitcoin ETF Demand Soars

BlackRock’s IBIT Sees Significant Growth Amid Rising Institutional Demand for Bitcoin ETFs BlackRock’s iShares Bitcoin Trust (IBIT) has experienced a notable surge in assets under management (AUM), with its AUM reaching $70,984,989,642 as of May 23, 2025. This growth reflects a broader trend of increasing institutional interest in Bitcoin ETFs, signaling potential mainstream adoption of […]

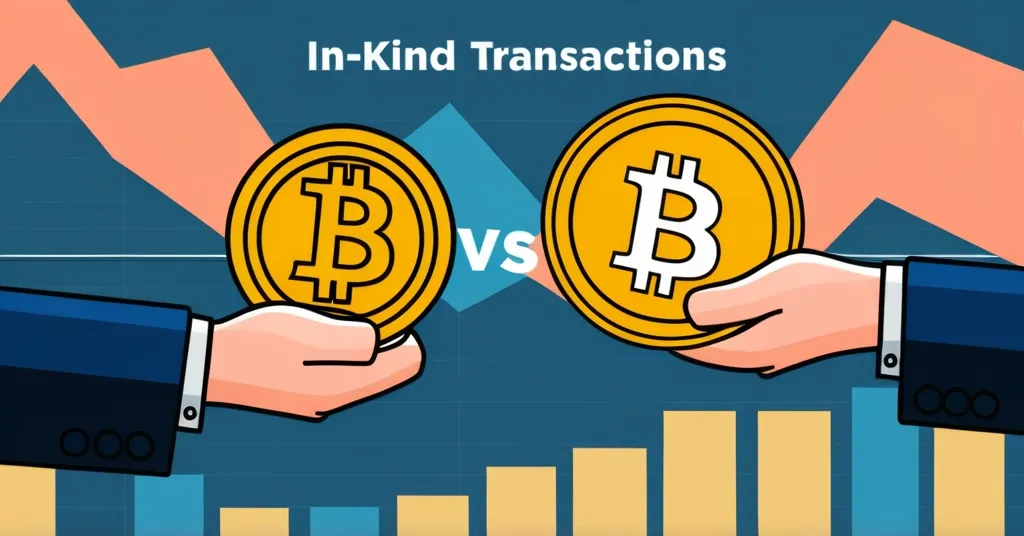

Read MoreSEC Reviews BlackRock’s Ethereum ETF Proposal with In-Kind Redemptions

SEC Acknowledges BlackRock’s In-Kind Redemption Proposal for Ethereum ETF Could BlackRock’s proposed Ethereum ETF change the game for crypto investors? The U.S. Securities and Exchange Commission (SEC) has taken a significant step by acknowledging BlackRock’s proposal for in-kind redemptions in its spot Ethereum ETF, sparking optimism and signaling a potential shift in the regulatory landscape. […]

Read MoreBitcoin Surges to 5th-Largest Asset, Overtakes Amazon at $110K

Bitcoin Surges Past Amazon to Become Fifth-Largest Global Asset – Bitcoin reaches new high of $110,000, market cap hits $2.205 trillion. – Institutional demand and favorable political climate fuel Bitcoin’s rise. – BlackRock’s iShares Bitcoin Trust (IBIT) sees massive inflows, holding 3.3% of all BTC. On Bitcoin Pizza Day, the cryptocurrency didn’t just celebrate its […]

Read MoreBlackRock’s IBIT Surges Past MicroStrategy with $3.92B Bitcoin Buy

BlackRock’s Bitcoin ETF Surges Ahead of MicroStrategy with $3.92 Billion BTC Acquisition BlackRock’s Bitcoin ETF, IBIT, has recently outpaced MicroStrategy in Bitcoin accumulation, adding 41,452 BTC valued at nearly $4 billion over the past two weeks. BlackRock’s IBIT now holds 614,639 BTC MicroStrategy (MSTR) holds 555,450 BTC Institutional interest in Bitcoin is on the rise […]

Read MoreBlackRock and SEC Discuss In-Kind Redemptions for Crypto ETFs

BlackRock and SEC Explore Next Phase of Crypto ETFs with In-Kind Redemptions Imagine being able to trade your ETF shares directly for Bitcoin. That’s the future BlackRock and the SEC are discussing. On April 1, 2024, BlackRock, the titan of asset management, sat down with the U.S. Securities and Exchange Commission’s (SEC) Crypto Task Force […]

Read MoreBlackRock CEO Warns of U.S. Dollar Decline, Sees Bitcoin as Threat

BlackRock CEO Warns U.S. Debt Could Weaken Dollar’s Global Role to Bitcoin BlackRock CEO Larry Fink has issued a stark warning about the potential decline of the U.S. dollar due to the country’s rapidly increasing debt. In his annual letter, Fink not only highlights the alarming growth of national debt but also points to Bitcoin […]

Read MoreTokenized Securities Hit $4.8B as Investors Seek Stability Post-Bitcoin Peak

Tokenized Securities Surge as Investors Seek Stable Passive Income Following Bitcoin’s peak above $109,000, investors are increasingly turning to tokenized securities, particularly US treasuries, for more predictable passive income. Tokenized treasuries reach $4.6 to $4.8 billion Institutional and protocol demand drives growth BlackRock and Franklin Templeton lead issuance Imagine parking your crypto earnings in a […]

Read MoreBlackRock’s BUIDL Fund Hits Solana, Boosts Tokenized Assets to $1.7B

BlackRock’s BUIDL Fund Expands to Solana, Pioneering Tokenized Assets BlackRock has broadened its BUIDL fund to the Solana blockchain, now accessible on seven networks, as part of a surge in tokenized asset interest. Launched in March 2024, BUIDL has exceeded $1 billion in assets under management, offering U.S. dollar yield to qualified investors. BUIDL now […]

Read MoreBlackRock’s iShares Bitcoin ETP Launches in Europe: A Leap Forward for Institutional Crypto

BlackRock Launches iShares Bitcoin ETP in Europe: A Milestone for Institutional Crypto Adoption BlackRock has taken a significant step in expanding its cryptocurrency offerings by launching the iShares Bitcoin ETP in Europe, marking its first crypto ETP outside of North America. This move signifies a growing institutional acceptance of Bitcoin as an investable asset. BlackRock […]

Read MoreBlackRock Pushes for Staking in Ethereum ETFs Amid Market Challenges

BlackRock’s Bold Move: Pushing for Staking in Ethereum ETFs Amid Market Turbulence BlackRock’s push to include staking in Ethereum ETFs could be a game-changer for the crypto market. The firm believes that this feature, absent from current ETFs, is crucial for attracting investors and revitalizing interest in Ethereum. BlackRock advocates for staking in Ethereum ETFs […]

Read MoreEthena Overtakes PancakeSwap and Jupiter, Hits $3.28M Daily Revenue

Ethena Surges Ahead: Overtakes PancakeSwap and Jupiter with $3.28M Daily Revenue Ethena, the Ethereum-based decentralized stablecoin protocol, has made a significant impact in the DeFi sector by surpassing the daily revenue of established protocols like PancakeSwap and Jupiter, securing the third position in daily fees with an impressive $3.28 million. While this success is notable, […]

Read MoreLarry Fink Urges Investors to Buy 2025 Market Dip Amid AI Growth

Larry Fink’s 2025 Market Advice: Buy the Dip Amid AI-Driven Growth – BlackRock CEO Insights Larry Fink, CEO of BlackRock, advises investors to buy into a market downturn if it occurs in 2025, predicting turbulence due to trade tensions but maintaining long-term optimism fueled by AI advancements. Larry Fink advises to buy during a “big […]

Read MoreSEC Delays BlackRock’s Ethereum ETF Options Until 2025 Amid Bitcoin ETF Success

SEC Delays Decision on BlackRock’s Ethereum ETF Options: A Closer Look The U.S. Securities and Exchange Commission (SEC) has postponed its decision on approving options for BlackRock’s iShares Ethereum Trust ETF (ETHA) until April 9, 2025. This delay keeps investors on the edge of their seats, especially given the stark contrast with the rapid success […]

Read MoreBlackRock Expands Bitcoin Reach with New ETP Launch in Europe

BlackRock’s Bitcoin Ambition: Launching an ETP in Europe BlackRock, the world’s largest asset manager, is set to expand its Bitcoin presence with a new Exchange-Traded Product (ETP) in Europe, following the success of its iShares Bitcoin Trust (IBIT) in the U.S. Here’s what you need to know: BlackRock to launch Bitcoin ETP in Europe Switzerland […]

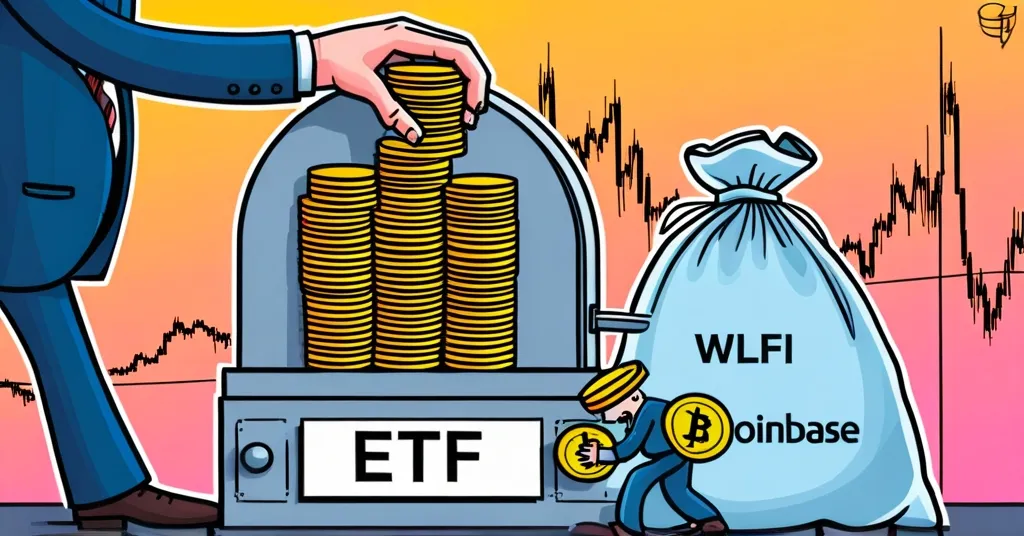

Read MoreBlackRock Boosts Ethereum with $276.2M Buy as WLFI Moves $307M to Coinbase

BlackRock Amps Up Ethereum Investment with $276.2M Purchase as Institutions Eye Crypto – BlackRock invests $276.2M in ETH for iShares ETHA ETF. – WLFI moves $307M in ETH and wBTC to Coinbase Prime. – Michaël van de Poppe predicts extended bull market. BlackRock, the financial behemoth managing around $11.5 trillion in assets, has recently invested […]

Read MoreNasdaq Files for In-Kind Redemptions on BlackRock’s Bitcoin ETF, Aiming to Boost Efficiency

Nasdaq’s Bold Move: Seeking In-Kind Redemptions for BlackRock’s Bitcoin ETF Nasdaq has filed with the SEC to allow in-kind redemptions for BlackRock’s iShares Bitcoin Trust (IBIT), a move that could revolutionize how the ETF operates. This proposal aims to let authorized participants trade ETF shares directly for Bitcoin, enhancing liquidity and tax efficiency. While this […]

Read MoreBlackRock Seeks In-Kind Redemptions for Bitcoin ETF, Boosting Institutional Efficiency

BlackRock’s In-Kind Bitcoin ETF Redemptions: A Leap Forward for Institutional Investors BlackRock, a titan in the asset management world, is pushing to transform its iShares Bitcoin Trust (IBIT) with a new in-kind redemption model. This change, aimed at streamlining processes for institutional investors, could mark a pivotal moment in Bitcoin’s integration into traditional finance. BlackRock […]

Read MoreNasdaq Proposes In-Kind Transactions for BlackRock’s $52.9B Bitcoin ETF

Nasdaq’s Proposal for In-Kind Transactions in BlackRock’s Bitcoin ETF: A Game-Changer? Nasdaq is shaking up the world of Bitcoin ETFs with a proposal to the SEC that could allow in-kind creation and redemption for BlackRock’s iShares Bitcoin Trust (IBIT). If approved, this move could streamline operations, boost transparency, and enhance liquidity for the ETF, which […]

Read MoreLarry Fink Calls for SEC Approval of Tokenized Stocks and Bonds

Larry Fink Urges SEC to Approve Tokenization of Stocks and Bonds Larry Fink, CEO of BlackRock, has called on the U.S. Securities and Exchange Commission (SEC) to approve the tokenization of stocks and bonds. Fink, a staunch advocate for blockchain technology, sees this move as pivotal for modernizing financial markets. Tokenization involves converting rights to […]

Read MoreBlackRock Boosts Bitcoin Holdings to $58.32B with $600M Purchase Amid Institutional Surge

BlackRock Boosts Bitcoin Holdings by $600M Amid Surging Institutional Interest BlackRock, the world’s largest asset manager, has intensified its Bitcoin investment, purchasing an additional $600 million worth of the cryptocurrency on January 22, 2025. This move increases their total holdings to 569,343 BTC, valued at approximately $58.32 billion, reflecting a strong commitment to Bitcoin amidst […]

Read MoreBlackRock’s Larry Fink Sees Bitcoin Hitting $700K Amid Market Volatility

BlackRock CEO Larry Fink’s Bold Bitcoin Prediction: A $700K Future? Larry Fink, CEO of BlackRock, has boldly predicted that Bitcoin could reach a staggering $700,000, signaling a major endorsement from one of the financial world’s most influential figures. Larry Fink predicts Bitcoin could reach $700,000. Bitcoin seen as a safeguard against economic turmoil. BlackRock’s iShares […]

Read MoreBlackRock CEO Larry Fink Sees Bitcoin as Hedge Against Instability, Predicts $1M Value

BlackRock’s Larry Fink Sees Bitcoin as a Global Hedge Against Instability Can Bitcoin really be the shield against global economic storms? BlackRock’s CEO, Larry Fink, believes so. In a no-holds-barred chat with Bloomberg, Fink outlined Bitcoin’s potential as a safeguard against economic and political turmoil, positioning it as a global asset. Larry Fink sees Bitcoin […]

Read More