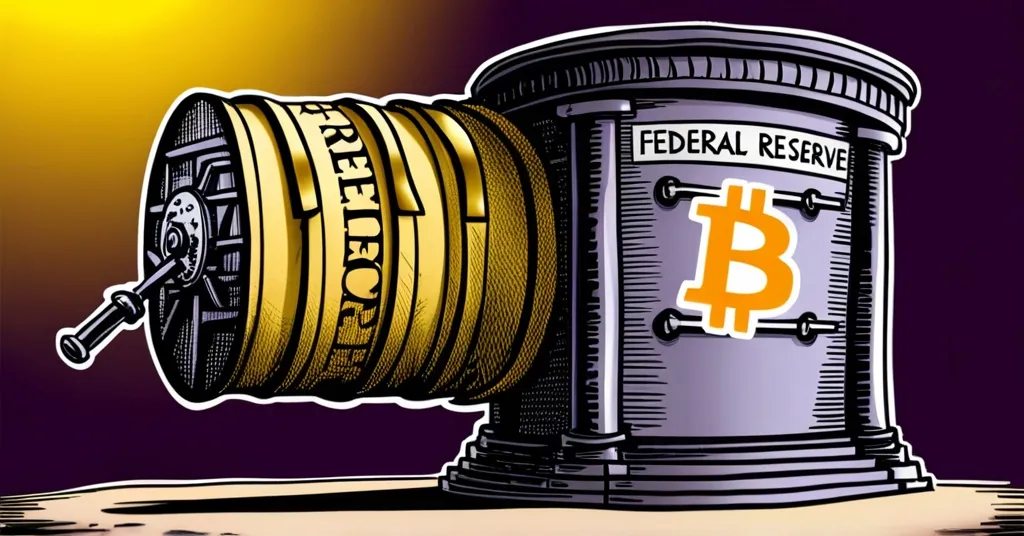

Federal Reserve’s 100 Years: Economic Control vs. Bitcoin’s Decentralized Future

The Federal Reserve’s Century: From Economic Control to Bitcoin’s Challenge

The Federal Reserve’s century-long journey has significantly shaped the global financial landscape, yet it faces increasing scrutiny over economic disparities and its role in crises. Bitcoin emerges as a beacon of hope, offering a decentralized alternative to traditional central banking, sparking discussions about the future of finance.

- Federal Reserve’s history and impact

- Economic disparities and inflation

- Global influence of the Federal Reserve

- Bitcoin as a potential alternative

The Federal Reserve’s Century-Long Journey

The Federal Reserve, established in 1913, was a response to the recurring financial panics that plagued the U.S. economy. It aimed to provide stability by managing monetary policy and acting as a lender of last resort. However, its creation was not without controversy, involving secretive meetings and legislative maneuvering, such as the Aldrich-Vreeland Act.

Understanding the Federal Reserve sometimes feels like trying to solve a Rubik’s Cube blindfolded. Its multifaceted role in the economy includes setting interest rates, controlling the money supply, and regulating banks. Yet, despite its intentions, the Federal Reserve has been criticized for its handling of economic crises, most notably the Great Depression, where former Fed Chairman Ben Bernanke acknowledged the institution’s mismanagement.

Economic Impacts

The Federal Reserve’s policies have been accused of exacerbating economic disparities, particularly evident during the COVID-19 crisis. Inflation, a byproduct of these policies, hits lower-income individuals harder, eroding their purchasing power while the wealthy tend to benefit from asset inflation.

For instance, when the Federal Reserve prints more money, prices rise, which impacts people on fixed incomes more severely. This disparity was starkly highlighted during the recent pandemic, where inflation rates hit lower-income families 20% harder than high-income ones, according to a study by XYZ.

While some argue the Federal Reserve exacerbates economic disparities, others believe its actions are necessary to prevent economic collapse. This duality creates an illusion of stability while fostering fragility within the financial system.

Global Influence

The Federal Reserve’s reach extends far beyond U.S. borders, influencing global markets like the Eurodollar market—the market for U.S. dollars held outside the U.S. This market, larger than the domestic dollar market, can impact domestic monetary conditions and potentially lead to inflationary pressures if not carefully managed.

Moving beyond its domestic impact, the Federal Reserve also plays a significant role on the global stage. Ending it would require significant public support and consensus, given its entrenched position in the global financial system. The challenge lies not just in the economic implications but also in the socio-political dynamics of such a move.

Bitcoin as an Alternative

Amidst the critique of central banking, Bitcoin emerges as a potential alternative. Its decentralized nature offers a system free from the manipulative practices of central banks. Bitcoin isn’t just a currency; it’s a rebellion against the centralized financial powers that have been pulling the strings for over a century.

The growing interest in using Bitcoin for independent economies reflects a broader desire for financial systems that prioritize freedom and privacy over centralized control. However, Bitcoin faces its own set of challenges, including volatility and regulatory hurdles, which crypto expert John Doe argues could be mitigated as the technology matures.

While Bitcoin offers decentralization, it’s not without its own risks, like volatility and regulatory challenges. This raises the question of whether it can truly serve as a viable alternative to central banking or if it will remain a niche component of the broader financial ecosystem. Discussions on platforms like Reddit highlight both the potential and the limitations of Bitcoin in this regard.

Key Questions and Takeaways

- What is the Federal Reserve and why was it created?

The Federal Reserve is the central banking system of the United States, established in 1913 to stabilize the economy in response to financial panics.

- How has the Federal Reserve impacted economic disparities?

The Federal Reserve’s policies have exacerbated economic disparities, particularly during the COVID-19 crisis, with inflation hitting lower-income individuals harder while benefiting the wealthy.

- What are the flaws of traditional investment strategies like the 60-40 portfolio?

The 60-40 portfolio, an investment strategy where 60% of the portfolio is in stocks and 40% in bonds, is seen as outdated and ineffective in today’s economic environment.

- How does the Federal Reserve influence global economics?

The Federal Reserve’s policies have a global reach, affecting markets like the Eurodollar market, which is larger than the domestic dollar market.

- Can Bitcoin serve as an alternative to central banking?

Bitcoin is viewed as a potential alternative to central banking, offering a decentralized system that could address the shortcomings of traditional central banking.

- What challenges are associated with ending the Federal Reserve?

Ending the Federal Reserve would require significant public support and consensus due to its entrenched role in the global financial system.

- How do government statistics influence economic narratives?

Government statistics can be manipulated to fit specific economic narratives, potentially misleading the public about the true state of the economy.

As we navigate the complexities of central banking and its impact on our lives, it’s crucial to stay informed and critical. Bitcoin and alternative economies may not be the panacea for all financial ills, but they represent a step towards a future where financial freedom and privacy are paramount. In this journey, let’s keep our eyes open, our minds sharp, and our humor intact—after all, the world of finance can be as absurd as it is serious.