Latest News and Articles about Federal Reserve

Trump’s Feud with Powell and Tariffs Fuel Bitcoin’s Decentralization Argument

Trump’s War on Powell and Global Trade: A Centralized Mess Fueling Bitcoin’s Case President Donald Trump’s escalating feud with Federal Reserve Chairman Jerome Powell over high interest rates, paired with a barrage of punishing tariffs on global trade partners, is shaking the financial world to its core. This dual assault on monetary and trade fronts […]

Read MoreTrump Slams Powell Over Fed Rates as Debt Crisis Fuels Bitcoin Appeal

Trump vs. Powell: Fed Rates Battle Heats Up Amid Debt Crisis and Crypto Potential President Donald Trump is waging war on Federal Reserve Chair Jerome Powell, blasting him as incompetent and pushing for interest rate cuts while the U.S. economy teeters under a $36 trillion national debt. As Powell defends the Fed’s steady stance amid […]

Read MoreBitcoin Holds $104K Support Post-Fed Rate Pause: Breakout or Breakdown Next?

Bitcoin Clings to $104,000 Support After Fed Rate Freeze: Rally or Rug Pull Ahead? Bitcoin (BTC) is holding its ground at the $104,000 mark, a critical support level, even as the US Federal Reserve opts to keep interest rates steady for the fourth straight meeting. While this decision initially doused hopes for risk-on assets like […]

Read MoreBitcoin at Crossroads: Chikou Span Hints Uptrend, $95K Crash Looms Amid Global Chaos

Bitcoin on the Brink: Chikou Span Signals Uptrend, Yet a $95,000 Crash Hovers Is Bitcoin poised for a breakout beyond $110,000 or staring down a savage drop to $95,000? As of mid-June 2025, with BTC trading at roughly $105,500, the market teeters on a volatile knife-edge. Technical charts flash glimmers of bullish hope, but a […]

Read MoreFederal Reserve Rates Unchanged: Bitcoin and Crypto at a 2024 Crossroads

Federal Reserve Holds Rates Steady: Bitcoin and Crypto Face a Double-Edged Sword in 2024 The Federal Reserve’s latest decision to keep interest rates unchanged at 4.25% to 4.5% is hardly a shocker, matching Wall Street’s expectations, but it’s a loud signal of the economic tightrope the U.S. is walking. With inflation creeping up, growth forecasts […]

Read MoreFed Dot Plot Chaos: Why Bitcoin Investors Should Beware Wall Street’s Obsession

Wall Street’s Fed Dot Plot Fixation: A Bitcoin Investor’s Wake-Up Call Wall Street’s unhealthy obsession with the Federal Reserve’s dot plot—a speculative chart of interest rate forecasts—keeps sending markets, including Bitcoin, on wild rides. As the Fed wraps up its December 17-18 meeting, traders are buzzing over whether the latest plot will hint at one […]

Read MoreTrump Targets Fed Chair Powell: Crypto Markets Brace for Impact

Trump’s War on Fed Chair Powell: A Shake-Up with Crypto Ripples Donald Trump has dropped a bombshell, announcing his intent to replace Federal Reserve Chair Jerome Powell with former Fed governor Kevin Warsh, while aggressively pushing for a massive interest rate cut. This power play isn’t just a political spat—it’s a direct challenge to centralized […]

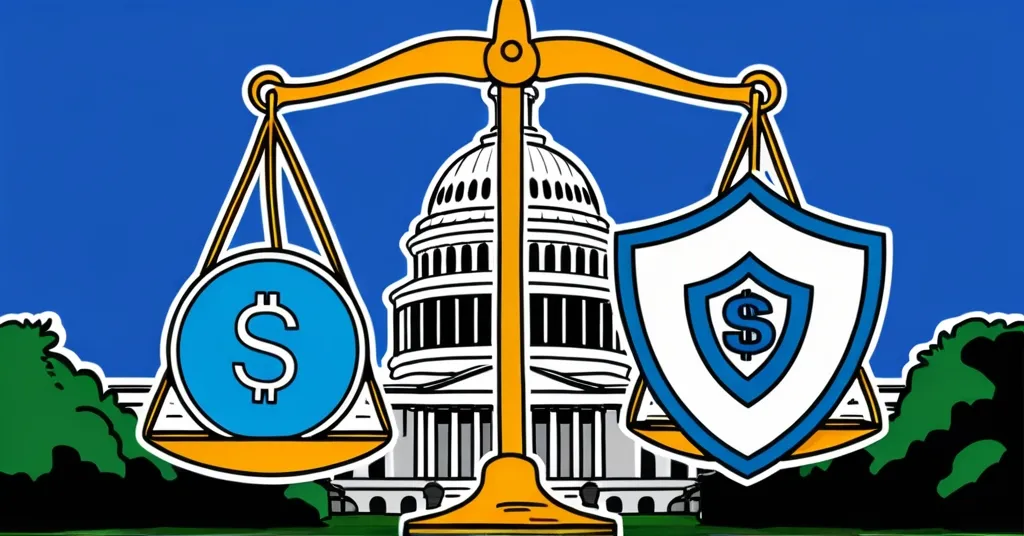

Read MoreSenators Race to Pass GENIUS Act for Stablecoin Regulation Before Memorial Day

Reviving the GENIUS Act: US Senators Push for Stablecoin Regulation Before Memorial Day US senators are making a concerted effort to revive the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which aims to bring stablecoins—digital currencies designed to maintain a stable value, often tied to the US dollar—under the regulatory umbrella of […]

Read MoreBitcoin Hits $101,784: Short Squeeze and Institutional Demand Fuel Historic Rally

Bitcoin Surges Past $100,000: Analyzing the Crypto Market’s Historic Rally on May 8 On May 8, Bitcoin soared past the $100,000 mark for the first time, marking a significant milestone in the cryptocurrency market. This surge was not just a lucky break but a result of a perfect storm of factors including a short squeeze, […]

Read MoreBitcoin’s MVRV Ratio Resets: Analyzing the Next Big Move

Bitcoin’s Market Reset: What’s Next for the Crypto Giant? Bitcoin’s MVRV Ratio has hit its long-term mean, hinting at a potential big move. With on-chain metrics, market pressures, and institutional moves shaping its future, let’s explore what’s on the horizon. Bitcoin’s MVRV Ratio resets to 1.74. 88% of Bitcoin’s supply in profit, no widespread capitulation. […]

Read MoreU.S. Fed Lifts Crypto Restrictions on Banks, Embracing Trump’s Vision

U.S. Federal Reserve Eases Crypto Regulations for Banks The U.S. Federal Reserve announced on April 24 a major policy shift, eliminating the requirement for banks to notify them before engaging in cryptocurrency-related activities. This move aligns with President Donald Trump’s campaign promise to foster a more crypto-friendly environment in the U.S., marking a significant step […]

Read MoreU.S. Economic Data This Week to Sway Bitcoin Price and Fed Policy

US Economic Indicators This Week Set to Influence Bitcoin’s Price Dynamics and Investor Sentiment U.S. CPI, PPI, and retail sales data due this week Federal Reserve’s policy decisions could be swayed Bitcoin’s volatility and investor sentiment key factors The U.S. economic calendar is packed with indicators this week that could significantly impact the cryptocurrency markets. […]

Read MoreElizabeth Warren Warns: Firing Jerome Powell Risks Market Crash

Firing Jerome Powell Could Crash Markets, Warns Elizabeth Warren Senator Elizabeth Warren has raised alarms about the potential economic fallout from President Donald Trump’s threats to fire Federal Reserve Chair Jerome Powell, cautioning that such a move could trigger a financial market crash. Warren warns of market crash if Powell fired Trump’s push for lower […]

Read MoreTrump Denies Inflation, Demands Fed Rate Cut, Slams China’s Tariffs: Crypto Implications

Trump’s Economic Stance: No Inflation, Fed Should Lower Rates, China’s Tariffs Ridiculous Trump denies inflation despite data showing 2.4% Urges Federal Reserve to cut interest rates Criticizes China’s “ridiculous” tariffs Former President Donald Trump recently dropped a bombshell on the economy, claiming that there is no inflation and urging the Federal Reserve to cut interest […]

Read MoreBlack Monday 1987: Lessons for Crypto and Financial Stability

Understanding Black Monday: Lessons from the 1987 Stock Market Crash On October 19, 1987, the financial world witnessed an unprecedented event known as Black Monday. The Dow Jones Industrial Average (DJIA) experienced a staggering 22.6% drop, or 508 points, in a single day, leading to a global financial crisis with losses totaling $1.71 trillion. This […]

Read MoreFed’s Powell Signals Patience Amid Tariff Hikes, Impacting Crypto Markets

Fed’s Powell Stays Patient Amid Tariff-Induced Economic Uncertainty Federal Reserve Chair Jerome Powell has announced a patient approach in response to President Donald Trump’s recent tariff hikes, signaling that the central bank will not rush to intervene as it did during the global economic crisis. Fed remains patient despite tariff hikes Robust labor market vs. […]

Read MoreTrump’s Bold Moves: Using Stablecoins and Cheap Oil to Outmaneuver the Fed

Trump’s Macroeconomic Chess: Stablecoins and Cheap Oil as Strategic Pawns Nigel Green, CEO of DeVere Group, asserts that President Donald Trump is deploying stablecoins and low oil prices as key tools in a strategic overhaul of U.S. macroeconomic policy, effectively sidestepping the Federal Reserve. Stablecoins and cheap oil: Trump’s macroeconomic levers Boosting demand for U.S. […]

Read MoreTrump’s Tariffs Trigger Crypto and Stock Market Synchronization in 2025

Are Crypto and Stocks Moving in Lockstep in 2025? In 2025, the financial landscape sees cryptocurrencies and traditional stocks more intertwined than ever, largely due to Donald Trump’s return to the White House and his high tariffs. The S&P 500 has dropped over 4%, while the global crypto market cap has plummeted by more than […]

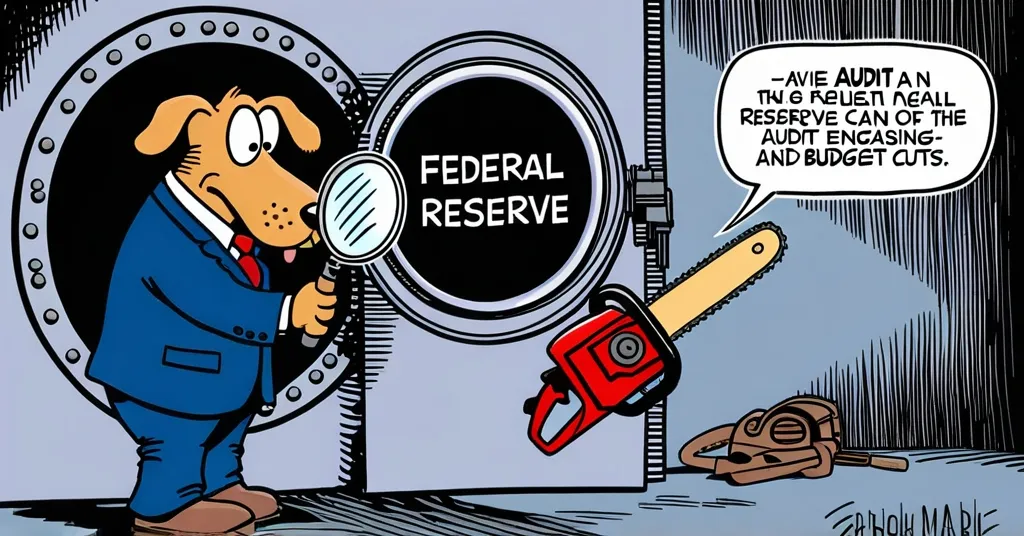

Read MoreElon Musk Proposes Dogecoin Audit of Federal Reserve at CPAC

Elon Musk Proposes Dogecoin Audit of Federal Reserve at CPAC: A Bold Move for Transparency At CPAC, Elon Musk shocked attendees by proposing a Dogecoin audit of the Federal Reserve, igniting a firestorm of debate on government transparency. Joined by President Javier Milei of Argentina, Musk’s vision for using DOGE in government oversight has sparked […]

Read MoreSEC and Fed Signal Crypto Thaw, Sparking Market Shifts

SEC Signals a Hands-Off Approach to Crypto The SEC and Federal Reserve are signaling a more permissive stance towards cryptocurrencies, which could lead to greater integration with traditional finance. Yet, this regulatory shift raises concerns about potential market disruptions and an uptick in illicit activities. SEC’s Hester Peirce suggests memecoins fall outside current jurisdiction Federal […]

Read MoreFed to Sell Gold for Bitcoin? Bernstein Predicts $20B National Reserve

Fed to Sell Gold for Bitcoin? Bernstein’s Bold Predictions for Crypto Funding Bernstein’s recent report has stirred the crypto world with its proposal for a national bitcoin reserve, potentially funded by the Federal Reserve selling gold reserves or issuing new debt. This could set a global precedent for how major economies view and utilize digital […]

Read MoreFed Governor Backs Bank-Issued Stablecoins, Calls for Regulation

Fed Governor Calls for Regulatory Framework Allowing Banks to Issue Stablecoins Federal Reserve Governor Christopher J. Waller has endorsed a regulatory framework that would enable banks and financial institutions to issue dollar-pegged stablecoins. Speaking at a recent San Francisco conference, Waller outlined the potential of stablecoins to enhance access to US dollars and streamline payments, […]

Read MoreMaxine Waters Proposes Bipartisan Bill to Regulate Stablecoins: Aims to Balance Innovation and Consumer Protection

Maxine Waters Unveils Bipartisan Bill to Regulate Stablecoins Representative Maxine Waters has introduced a draft bill aimed at establishing a regulatory framework for stablecoins in the United States, a move that could significantly shape the future of digital currencies. This bipartisan effort, developed over three years, seeks to balance encouraging new developments with robust consumer […]

Read MoreFederal Reserve’s Secret Document Unveils Role in Crypto Debanking Crisis

Federal Reserve Exposed for Role in Crypto Debanking Senator Cynthia Lummis recently revealed a classified Federal Reserve document during a Senate Banking Committee hearing, shedding light on the central bank’s involvement in the debanking of cryptocurrency companies under the Biden administration. This document, previously shrouded in secrecy, highlights the Federal Reserve’s internal guidelines for handling […]

Read More